2022 Review — performance and financial position

2022 was marked by the lengthy war in Ukraine, soaring energy costs as well as rising interest rates in an attempt to tame the highest inflationary pressures recorded since the 1970s.

Greece’s economy recorded solid growth in the first half of 2022, but rising inflation took its toll on growth in the second half of the year, while it is expected to affect years to come. European Commission, in its winter interim forecast (February 2023), has lifted its growth outlook at 0.8% in 2023 and 1.6% in 2024, while slightly lowered inflation projections for 2023, to 6.4%. Greece, is expected to grow by 1.2% in 2023 and by 2.2% in 2024, maintaining at the same time a below-EU-average inflation of 4.5% for 2023.

Although, energy price inflation has been eased recently in the EU, food inflation kicked in later in 2022, given the lagged pass-through effect of high energy costs on food production, while it is expected to prove more persistent. For European Union and Greece in particular, getting inflation under control is of significant importance, as it will gradually ease the burden on people’s real income and benefit consumption.

In this current, negative, international environment, the Greek economy has two critical allies. The first one, is the key contribution of the Recovery and Resilience Facility (RRF) to the Greek economy which is expected to exceed the €30bn (c.15% of country’s current GDP) over the course of the next few years, with "Green Transition" being one of the Facility’s key pillars.

At a time, cost of borrowing has gone up significantly, it is vital for an international business with strong growth prospects to have access to low-cost funding pockets. MYTILINEOS is very well-placed to maintain itself in this current growth trajectory, by funding its growth plans with a combination of its internally generated funds, along with cheap available funding, like the RRF as well as other tools offered by the EU.

The second, is a likely upgrade of Greece’s sovereign-debt rating to "Investment Grade", for the first time since the financial crisis, which in turn could result in a significant increase in foreign investment flows. The country is just one notch short of the investment-grade status, which will in turn rubber-stamp its return to fiscal normality.

In order for the country not to derail its course towards investment-grade, Greece has to maintain its reform path and fiscal prudence. For MYTILINEOS 2022 was a milestone year, as it managed to make a twofold transition, by both setting new levels of profitability, three times higher compared with the levels between 2017- 2021, as well as through its own, inner development via the recently announced corporate transformation, into MYTILINEOS Energy & Metals.

Key drivers of this performance are MYTILINEOS’ competitive advantages against both domestic and global competition, as well as the Company’s everincreasing internationalization of its activities. The speed of maturity, the completion of a number of new investments, the diversified business model, MYTILINEOS’ well-capitalized balance sheet, as well as significant synergies deriving among the Business Units, are key contributors, offering Management the ability to effectively exploit the opportunities arising in the current volatile environment, while safeguarding future profitability from exogenous factors, maintaining in that way MYTILINEOS’ steep growth trajectory in years to come.

Power & Gas Business Unit

2022 was characterized by extreme volatility in European natural gas prices, as a consequence of geopolitical turmoil, which coupled with high CO2 prices led to a significant increase in the wholesale price (DAM). As a result, 2022 electricity demand came in 3.4% below that 2021.

Regarding the Greek energy mix, natural gas has been maintained as the main production fuel with its contribution exceeding 37%, while for the first time RES participation, registering a record increase, reported slightly below 37%. Lignite and hydros participation came in at 11% and 8% respectively, while 2022 the import needs maintained at 2021 levels (7%).

The Company’s capacity to supply natural gas at competitive prices — due to the size of its portfolio, while natural gas imports make up 26% of the country’s total imports — along with the high degree of efficiency, availability, reliability and flexibility of its units, led total production to 4.89 TWh. This represents 9.6% of the total demand in the interconnected system and 25.9% of the generation from natural gas plants. The Compamy’s total production both from thermal and renewable units amounted to 5.42 TWh, which corresponds to 10.7% of the total demand.

The following chart shows the coverage (per energy source), of total electricity demand (in TWh) for 2021 and 2022:

Regarding the supply business of MYTILINEOS, Protergia is steadily strengthening its retail presence, closing 2022 with a representation of 345,000 power and gas meters in total. In addition, the market share of Protergia regarding the Power & Gas market in December 2022 reached 7.6% (EXE shares). MYTILINEOS, as part of its strategic planning for the development of its activities in the retail market of Power and Gas supply in Greece and the wider region, has agreed to acquire all shares of WATT+VOLT. The integration of WATT+VOLT and the enlargement of the customer base further strengthens the verticalization of the Power & Gas BU, forming an important step towards creating the utility of the new era ("Utility of the Future"). The latter could potentially be enhanced with an additional acquisition.

MYTILINEOS, committed to its goal to accelerate the development of its RES pipeline, is constantly enhancing its operating capacity, which currently stands at 256 MW. In December, a new 43.2 MW wind park has been put into trial operation, along with another 5.1MW, part of a wider group of 135MW PV which are expected to become operational during 2023. The latter is supported by the Recovery and Resilience Facility (RRF).

With RES being central for the Company’s growth, MYTILINEOS is accelerating the development of its total RES pipeline, comprising projects in different countries and different stages of development. Detailed analysis of the total global RES portfolio contained under the Renewable Sources & Energy Storage Development BU section.

Finally, the construction of the new 826 MW natural gas-fired combined cycle (CCGT) plant with General Electric (H-Class) gas turbine, will contribute decisively towards the country’s transition in an energy mix with significantly smaller carbon footprint. Commercial operation of the new CCGT will double the Company’s thermal installed capacity, while accounting for the combined heat and power plant (CHP) as well as RES, company’s total power capacity shall exceed the 2.3GW.

P&G Business Unit’s strong performance, owed primarily to both the high efficiency of the Company’s plants as well as its ability, due to the size of its portfolio, to secure natural gas at competitive prices, through a wide and diverse network, via both LNG cargoes and pipeline gas. In that way, MYTILINEOS is securing sufficient natural gas quantities, in a period of very high energy prices, while achieving, at the same time, significant penetration in neighboring markets.

Power & Gas Business Unit — Prospects for 2023

MYTILINEOS, operating c.2.3 GW of installed thermal (consuming selfimported natural gas) and RES plant capacity, holds the 1st position among the independent power suppliers, having been established as the largest vertically integrated electricity and natural gas company, reaching the critical size to fully benefit from the liberalization of the domestic electricity and natural gas market.

2023 is expected to continue to be affected by the highly volatile natural gas prices as well as high CO2 prices. However, except from the case of an extreme event, P&G BU’s financial performance is expected to reach new highs due to:

i. the commercial production of the new 826 MW Combine Cycle Natural Gas Fired (CCGT) plant,

ii. the continues access to competitive and flexible sources of Natural Gas supply, through direct contracts with large international producers and suppliers

iii. the LNG supply, where MYTILINEOS has a significant advantage over competition, due to its long experience and the extended network of suppliers

iv. the highly efficient electricity and natural gas portfolio management (energy management/ supply and trading),

v. the increased volume and the continuously growing activity in retail electricity & natural gas market, adapting to the new market conditions

vi. the commercial operation of the new 43.2MW wind park as well as the gradual operation of the 135 MW PV parks

vii. domestic electricity consumption growth due to the improvement of economic activity

viii. the addition of WATT+VOLT’s portfolio of 200,000 customers, taking cumulative market share of electricity supply and natural gas to 10%, with 550,000 customers and almost 100 stores, while at the same time MYTILINEOS will enhance its presence in electrification with 516 charging stations across the country

Metallurgy Business Unit

2022 3M LME Aluminium average price, came in at 2,716$/t vs 2,486$/t in 2021, marking a c.10% increase year-on-year. Aluminium price skyrocketed to an all-time high at the $4,000/t level during Q1 2022, mainly due to the geopolitical crisis in Ukraine, the steep rise in energy cost, while at the same time there was also a strong concern regarding the availability of the metal. During Q2 and Q3 2022, aluminium prices de-escalated back to the $2,100/t area, among others, due to the growing concerns of a slowdown in global economic activity, anticipation of interest rate rises, as well as due to the strengthening of the US dollar. High energy costs and the correction of aluminum prices significantly compressed the profit margins of many producers, leading to aluminium production cuts mainly in Europe and the US. This resulted in more than 1Mt of primary aluminum production in Europe being lost, either temporarily or permanently, which in turn led Europe to a 30 year low in terms of aluminium production. At the same time, another 0.5 Mt remain at risk, particularly at a high energy prices environment.

Since late Q3-2022, aluminium prices are strengthening and recently are trading around the $2,600/t mark. The recent rise of the LME price, on top of the "green transition" fueled increase in the aluminium demand, could also be related to both the reduction in global aluminum inventories, which are now at a 20-year low, as well as to the better-than-expected course of the global economy, and in particular the higher expected demand for the metal in China and Europe, as well as the reduced aluminum production both in the European continent, as stated above, as well as in China.

The Alumina Price Index (API), following the aluminium price trend, recorded a c.10% increase to $362/t. Significant production cuts were also noted in the market of alumina in Europe with a high percentage of plants operating at a loss.

The significant increase in profitability is, among others, due to the steep rise in European aluminium Premia, during 2022, as well as due to the significant improvement in profit margins, the result of continuous investments in an effort to increase productivity, coupled with timely actions to address the various cost parameters and particularly the energy costs.

MYTILINEOS, has taken prompt actions in order to take measures to mitigate the various cost parameters, especially regarding the energy cost, while making full utilization of both the record-high LME prices in H1 2022, as well as the strengthening of the US Dollar against Euro, and the flexibility of the use of alternative fuel for alumina production, has consistently secured high profitability going forward, remaining among the lowest cost aluminum producers globally, being consistently in the top quartile of the global cost curve.

Metallurgy Business Unit — Prospects for 2023

Metallurgy Business Unit 2023 prospects are expected favorable as we have already secured low energy prices to maintain our cost competitiveness while at the same having secured higher LME prices. Flexibility and adaptability will dominate in the whole spectrum of Metallurgy’s activities as:

i. We observe volatility in aluminium, energy and raw material prices while at the same time aluminum shows a demand destruction, which in turns affects premiums.

ii. 2023 is the first year of Aluminum of Greece energy supply partial disconnection from PPC, while we are exploring alternatives on the bauxite supply and consumption front.

iii. After a record sales year for non-metallurgical grade alumina, we are aiming for even higher sales going forward.

iv. Secondary aluminum production, at EPALME, should record a record 2023 performance.

v. We move fast towards digital transformation to improve technical performance and reduce our environmental footprint.

Renewables & Storage Development Business Unit (RSD BU)

This steep rise of EBITDA (384% compared to 2021), on top of the turnover increase, is due to the significant strengthening of the Business Unit’s profit margin, as a result of a much greater contribution of BOT (Build Operate & Transfer) projects compared to the 3rd party EPC projects, in the profitability mix. BOT projects, which will maintain the ¨lion’s share¨ of the profitability from 2022 onwards, come with a significantly higher profit margin vs 3rd party EPC projects.

In particular, during 2022, MYTILINEOS completed the signing of project sales agreements (SPAs) for the following projects:

i. 110 MW in United Kingdom

ii. 210 ΜW in Romania

iii. 26 MW in Cyprus

In the context of the Global Energy Transition, through the shift towards Renewable Energy Sources, as well as the Sustainable Development Strategy adopted by the Company in recent years, RSD Business Unit concluded, during 2022, bilateral electricity supply agreements between RES producers and final consumers ("green" PPAs — Power Purchase Agreements):

i. Chile, 588 MW, 4 PV Projects, Customer: ENEL Chile

ii. United Kingdom, 110 MW, 3 PV Projects, Customer: VODAFONE UK, CENTRICA UK

iii. United Kingdom, 232 MW, 5 PV Projects, Customer: VODAFONE UK, CENTRICA UK

iv. Italy, 63 MW, 4 PV Projects, Client: Statkraft

During 2022 the Business Unit completed the financing process (without recourse or guarantees from the parent company — non-recourse financing) for three solar farms in Australia, with total capacity of 237 MW and a total funding of AUD 234m.

MYTILINEOS’ global RES pipeline, as described above, comprising projects at different stages of development with total capacity of 9.1 GW, of which:

A. 539 MW in operation (of which 283 MW abroad)

B. c.1.0 GW under construction (of which 827 MW abroad)

C. c.2.2 GW in mature stage of development, i.e. projects in either RTB or soon-RTB stage (of which c.1.5 GW abroad)

D. >5 GW in less mature stage of development (of which c.4 GW abroad)

Additionally, MYTILINEOS owns 1.1 GW of Greek energy storage projects, currently at an early stage of development.

The new energy environment, as it has been shaped in global energy markets, opens up new development prospects for the RSD Business Unit, not only for the development of projects, but also for securing higher valuations for RES units, particularly those in a mature stage of development.

Regarding 3rd party EPC projects, the execution continues without problems in countries such as Spain, the United Kingdom, Greece, Uzbekistan and Chile, with the contracted balance (signed backlog) standing at €87 million, while additionally €526m are in final negotiation phase.

| International Renewables and Storage Development | |||

|---|---|---|---|

| (Amounts in thousands €) | up to 1 year | 1-3 years | Total |

| Great Britain | 41,809 | - | 41,809 |

| Greece | 27,672 | - | 27,672 |

| Italy | 12,592 | - | 12,592 |

| Chile | 4,349 | - | 4,349 |

| Spain | 1,065 | - | 1,065 |

| Total | 87,486 | - | 87,486 |

Sustainable Engineering Solutions Business Unit (SES BU)

The Company, having the recognition of the market as a leading TurnKey projects constructor while utilizing its strong track record in the development of energy projects, in 2022, came into an agreement to execute a series of important contracts. In particular, in the United Kingdom an agreement was reached for the “Design, Supply & Construction“ of three open cycle power plants (OCGT) and the ”Supply and installation of a Synchronous Condenser“. In Poland, as a member of a consortium, it undertook the construction of a 560MW combined cycle unit, which is also the Company’s first project in this particular market. In Ireland, GE and MYTILINEOS have undertaken the construction of a new 200MW plant for the country’s Public Electricity Company. In Greece, four contracts were signed with HEDNO, for the Construction and maintenance of distribution network projects, while a contract was also signed with IPTO for the construction of a 400kV Electricity Transmission Line for the electrical interconnection between Greece and Bulgaria. The Company has also undertaken the street lighting of the Municipalities of Athens and Corinth, the KiatoRio electrification project and the construction, operation and maintenance of the “New Eastern Ring Road of Thessaloniki” (Flyover) as a member of a joint venture, while it has also undertaken the construction of the largest data center in Greece.

In the field of environmental solutions, great prospects are recognized, especially for wasted-energy recovery projects, such as the "Protos Energy Recovery Facility" that the Company is already building in England. MYTILINEOS is actively engaged in discussions to undertake similar projects, some of which are considered mature and expected to enhance the Company’s backlog.

At the end of 2022, the backlog of contracted projects amounted to €1.66 billion.

| Sustainable Engineering Solutions | |||||

|---|---|---|---|---|---|

| (Amounts in thousands €) | up to 1 year | 1-3 years | 3-5 years | > 5 years | Total |

| GREECE | 239,720 | 287,123 | 195,397 | 2,460 | 724,701 |

| LIBYA | 90,284 | - | - | - | 90,284 |

| UNITED KINGDOM | 368,660 | 85,893 | 12,987 | - | 467,540 |

| POLAND | 71,480 | 127,870 | 549 | - | 199,899 |

| ALGERIA | 21,800 | - | - | - | 21,800 |

| ALBANIA | 16,130 | 4,694 | - | - | 20,824 |

| GEORGIA | 27,450 | 6,683 | 9 | - | 34,142 |

| GHANA | 14,318 | - | - | - | 14,318 |

| IRELAND | 42,630 | 26,700 | 8,000 | - | 77,330 |

| OTHER | 6,556 | 5,552 | - | - | 12,108 |

| Total | 899,028 | 544,516 | 216,942 | 2,460 | 1,662,946 |

While including projects at an advanced stage of contracting, the total pipeline amounts to €2.95 billion, of which c. 40% concerns projects in Greece and 28% projects in the UK. Significant growth rates are expected in both the construction and concessions sectors.

The European Recovery Fund offers opportunities for both green growth and infrastructure projects. The Company, possessing the know-how required for high-demand projects, aims to fully utilize the important perspectives opened by the European Recovery Fund.

Prospects for 2023 Ex. Sustainable Engineering Solutions Business Unit (SES BU)

A new historical chapter begun on December 14, 2022following the official announcement of the Company’s corporate transformation. The new structure will allow the company to respond more effectively to the challenges of the energy transition and digital transformation, focusing on sustainable development and the circular economy. At the same time, the new corporate transformation upgrades MYTILINEOS in the field of infrastructure with the creation of two new subsidiaries, which will be strategically positioned, to properly exploit the opportunities both in Greece and internationally. Specifically, the following companies have been created: METKA ΑΤΕ, which will specialize in the construction industry (general contracting) and M Concessions, which will be the investment arm in concessions and PPP projects in Greece and abroad. These two companies will claim a large market share of Infrastructure, PPP and Concession projects that will be auctioned in the coming years. At the same time, our goal is for our activity in the compared object to expand abroad.

At the same time, MYTILINEOS, through Division M Power Projects (ex. Sustainable Engineering Solutions Business Unit), seeks to further consolidate itself in the field of conventional electricity production projects, such as the construction of thermal plants, but also innovative energy projects such as units Waste-to-Energy, energy transition projects (distribution networks, hydrogen, etc.), as well as electricity saving projects, digital transition, smart cities and IoT platforms.

MYTILINEOS is aware of international trends, hence utilizes its experience and know-how and:

a) It leverages its competitive advantage in the manufacturing of thermal units to further develop in the field of Transmission & Distribution (T&D).

b) Seeks great potential for expansion, based on its increased expertise in circular economy solutions — particularly in the waste-to-energy sector, where it is recognized as a leading large-scale turn-key contractor. In addition to the Protos ERF, a 400,000 tonnes per annum non-recyclable waste-to-energy project in the UK, with the potential to generate of up to 49MW, which is currently underway, MYTILINEOS has a number of other similar projects in exclusive discussions with multiple customers.

c) It focuses new technology markets such as Hydrogen, CCS, Data Centers, Smart Cities, aiming to lead the developments that will lead to a more sustainable future.

The company, following its strategic planning, is oriented towards the development of its activities in countries with special requirements, where its prestige and know-how gives it an important position in the international market. Where good investment opportunities are identified, it intends to utilize its significant project financing capabilities to create even greater added value for both its customers and its shareholders. The Company’s strategy focuses on its backlog increase during 2023, by undertaking new projects in targeted markets and focusing on the timely execution of existing contracts.

The planning and prospects for the individual activities are summarized as follows:

In Greece, the 826 MW combined cycle power plant (CCGT) is in trial operation moving to commercial operation. The state-of-the-art Data Center ATH 3 of Digital Realty, the largest in Greece, covering an area of of 8,600 sq.m. has been built according to Tier III standards and will be LEED certified, is in the final phase of construction. Abroad MYTILINEOS continues to build projects in Libya, Ghana, the United Kingdom, Ireland, Albania, Georgia, Slovenia and Poland. Having leading position in the undertaking and execution and construction of power generation units with natural gas fuel, is now targeting projects in Europe and Sub-Saharan Africa. MYTILINEOS, having the required experience, claims a significant share for electricity transmission and distribution network projects in Greece, Europe and Africa.

MYTILINEOS continues to develop dynamically in markets with high demands for the execution of complex technical projects, capitalizing on its 20 years of experience in similar projects.

Regarding the activity that the two new subsidiaries of MYTILINEOS are going to develop:

The company expects to develop in the field of infrastructure, through PPP projects and projects that require a high level of know-how, a holistic approach and targeting the result, in view of the large projects that have been announced in Greece in the context of the post-Covid era.

The Company, holding a 7th grade construction degree in Greece, as part of its business planning, selectively seeks to claim the tendered infrastructure, building, environmental and other projects mainly within Greece, through construction contracts, PPP contracts or concession contracts. In this context, it continues the implementation of the construction of signed projects, while at the same time will start the execution of 2 Railway Projects in Peloponnese. Namely the Electrification project in the Kiato — Rododafni section, as well as the extension of Railway infrastructure — Electrification — construction of Stations in the area Rododafni-Rio. Also, within 2023, the Company will commence the implementation of the PPP contract for the major road project of Regional Thessaloniki "FLYOVER".

In addition to large-scale energy environmental projects, the company is strategically investing in Environmental Solutions and expanding into solid waste management, as well as the development of biogas and waste management units, and is selectively considering project financing cases, having already expressed interest in participating in related PPP tenders in Greece.

In the area of sludge management, liquid waste and environmental remediation, it implements a plan for its systematic penetration initially in Europe and North Africa, making use of the added value provided by the special know-how of the ZEOLOGIC subsidiary, where it acts as a pioneering technology provider in this specific market.

Prospects for 2023

Although, current economic environment remains fluid and full of uncertainties, MYTILINEOS has paved its way for the future, via its recent corporate transformation, while it has already laid the foundations for an even stronger profitability in years to come, relying, among others, on:

i. The acceleration of the development of both the Greek and the international RES portfolio, as the Company has already matured a significant part of its total Global RES portfolio of 9.1 GW, while it maintains the liquidity required to accelerate its "Green" Transition.

ii. The contribution in profitability, for the first time during 2023, of the new highly efficient new CCGT of 826 MW, which will become a key driver for the strengthening of the Company’s market share, towards the 20% level.

iii. Metallurgy’s elevated profitability, the result of appropriate hedging actions regarding metal price fluctuations as well as the €/$ exchange rate, while maintaining competitive production costs, particularly with regards to the energy costs.

Total Impact on Group Sales and EBITDA

Specifically, the effect in Group’s turnover, EBITDA and Net Profit during 2022 compared with previous year is presented below:

A. Sales

| Amounts in mil. € | Group Total | Power & Gas Sector | Metallurgy | Renewables and Storage Development | Sustainable Engineering Solutions | Other | Group Total | |

|---|---|---|---|---|---|---|---|---|

| Sales 2021 | 2,664 | 1,261 | 668 | 365 | 371 | - | 2,664 | |

| Intrinsic Effect | 751 | Volumes | 444 | 3 | 447 | |||

| Shut-Down income | ||||||||

| Projects | 7 | 256 | 39 | 301 | ||||

| Intrasegment Eliminations | ||||||||

| Other | 3 | 3 | ||||||

| Market Effect | 2,956 | Organic $/€ eff. | - | 67 | 10 | 16 | 92 | |

| Premia & Prices | 2,729 | 135 | 2,864 | |||||

| CACs | - | - | ||||||

| Other | ||||||||

| Hedging | (64) | (64) | (64) | |||||

| Sales 2022 | 6,306 | 4,434 | 817 | 630 | 425 | - | 6,306 |

B. EBITDA

| Amounts in mil. € | Group Total | Power & Gas Sector | Metallurgy | Renewables and Storage Development | Sustainable Engineering Solutions | Other | Group Total | |

|---|---|---|---|---|---|---|---|---|

| EBITDA 2021 | 359 | 147 | 159 | 22 | 33 | (3) | 359 | |

| Intrinsic Effect | 70 | Projects | 3 | 74 | 52 | 129 | ||

| Settlements | ||||||||

| Volumes | 24 | (0) | 24 | |||||

| Other | (59) | (12) | (12) | (83) | ||||

| Market Effect | 359 | Premia & Prices | 135 | 135 | ||||

| Raw Materials prices | (52) | (52) | ||||||

| €/$ rate effect | 47 | 0 | 3 | 50 | ||||

| Natural Gas Price effectIncluding NG supply price effect for Power & Gas | (331) | (51) | (382) | |||||

| CO2 | (45) | 17 | (28) | |||||

| RTBM / Day Ahead Market | 564 | 564 | ||||||

| Net Energy Cost | 71 | 71 | ||||||

| Other | ||||||||

| Hedging | 36 | 25 | 9 | 2 | 36 | |||

| EBITDA 2022 | 823 | 373 | 270 | 105 | 91 | (15) | 823 |

C. Net Profit after minorities

| Amounts in mil. € | Power & Gas Sector | Metallurgy | Renewables and Storage Development | Sustainable Engineering Solutions | Other | Group Total |

|---|---|---|---|---|---|---|

| Net Profit after Minorities 2021 | 162 | |||||

| Effect from: | ||||||

| Earnings before interest and income tax (EBIT) | 128 | (36) | 80 | 295 | (12) | 455 |

| Net financial results | (41) | |||||

| Minorities | (16) | |||||

| Discontinued Operations | (2) | |||||

| Income tax expense | (92) | |||||

| Net Profit after Minorities 2022 | 466 | |||||

D. Sales and Earnings before interest, taxes, depreciation, and amortization per Business Unit Sales & EBITDA

| (Amounts in thousands €) | Power & Gas | |||||

|---|---|---|---|---|---|---|

| Sales | Energy Supply | Energy Production | Natural Gas Supply | RES | Intrasegment Eliminations | Total |

| 31/12/2022 | 1,626,131 | 1,154,532 | 2,346,436 | 77,706 | (770,851) | 4,433,953 |

| 31/12/2021 | 837,875 | 595,492 | 156,887 | 53,127 | (382,496) | 1,260,885 |

| EBITDA | ||||||

| 31/12/2022 | 18,452 | 173,619 | 120,897 | 59,652 | - | 372,619 |

| 31/12/2021 | (60,506) | 155,419 | 12,532 | 39,594 | - | 147,039 |

The Companies which are consolidated with equity method and own Renewable Energy Units with capacity of 1.7MW are not included in the amounts of RES.

| (Amounts in thousands €) | Metallurgy | |||

|---|---|---|---|---|

| Sales | Alumina | Aluminium | Metalwork / Other | Total |

| 31/12/2022 | 190,195 | 582,637 | 44,559 | 817,391 |

| 31/12/2021 | 140,165 | 488,753 | 38,674 | 667,592 |

| EBITDA | ||||

| 31/12/2022 | 32,529 | 221,238 | 16,478 | 270,245 |

| 31/12/2021 | 26,482 | 119,426 | 13,416 | 159,325 |

| (Amounts in thousands €) | Renewables and Storage Development | |||

|---|---|---|---|---|

| Sales | Total | |||

| 31/12/2022 | 630,151 | 630,151 | ||

| 31/12/2021 | 364,903 | 364,903 | ||

| EBITDA | ||||

| 31/12/2022 | 104,620 | 104,620 | ||

| 31/12/2021 | 21,634 | 21,634 | ||

| (Amounts in thousands €) | Sustainable Engineering Solutions | |||||

|---|---|---|---|---|---|---|

| Sales | Conventional Business | Infrastructure | New Energy Solutions | New Enviromental Solutions | Total | |

| 31/12/2022 | 190,502 | 115,698 | 42,540 | 76,237 | 424,977 | |

| 31/12/2021 | 181,804 | 141,032 | 11,971 | 35,863 | 370,670 | |

| EBITDA | ||||||

| 31/12/2022 | 68,011 | 13,208 | 4,662 | 4,833 | 90,714 | |

| 31/12/2021 | 14,258 | 16,615 | 1,096 | 1,525 | 33,495 | |

| (Amounts in thousands €) | Other | Total |

|---|---|---|

| Sales | ||

| 31/12/2022 | - | - |

| 31/12/2021 | - | - |

| EBITDA | ||

| 31/12/2022 | (14,921) | (14,921) |

| 31/12/2021 | (2,985) | (2,985) |

The Group has a policy of evaluating its results and performance on a monthly basis, identifying timely and effective deviations from the objectives and taking corresponding corrective measures. The Group measures its efficiency using the following financial performance indicators that are widely used internationally. It is pointed out that the following indicators are Alternative Performance Measurement Indicators (APMIs), which are not defined or defined in IFRS. The Group considers these figures to be relevant and reliable for the evaluation of the Group’s financial performance and position, however they do not replace other figures calculated in accordance with IFRS.

EBITDA (Operating Earnings Before Interest, Taxes, Depreciation & Amortization): The Group defines the "Group EBITDA" quantity as profits/losses before tax, itemized for financial and investment results; for total depreciation (of tangible and intangible fixed assets) as well as for the influence of specific factors, i.e. shares in the operational results of associates where these are engaged in business in any of the business sectors of the Group, as well as the influence of write-offs made in transactions with the aforementioned mentioned associates.

ROCE (Return on Capital Employed): This index is derived by dividing profit before interest, taxes, depreciation & amortization, to the total capital employed by the Group, these being the sum of the Net Position; Total Debt; and Long — term forecasts.

ROE (Return on Equity): This index is derived by dividing profit after tax by the Group’s Net Position.

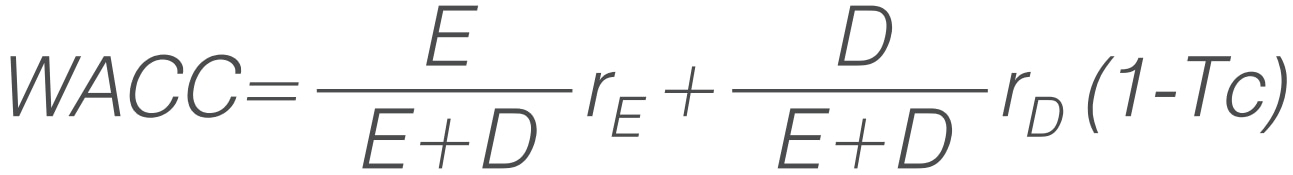

EVA (Economic Value Added): This metric is derived by multiplying the total capital employed with the difference (ROCE — Capital Expenditure) and constitutes the amount by which the financial value if the company increases. To calculate the capital expenditure, the Group uses the WACC formula — " Weighted Cost of Capital".

The Weighted average cost of capital is calculated as, the quotient of Equity Capital to Total Capital Employed (Equity Capital and Debt) multiplied by the return on

Where

E Equity Capital

D Debt

rE Return on equity

rD Return on debt

Tc Tax rate

The calculation of the indicator Weighted Average Cost of Capital (WACC) for the 2022 sums to 8.77% and is based on the countries in which the Group operates.

The above indicators for 2022 compared with 2021 are as follows:

EBITDA & EVA in thousands €

| 2022 | 2021 | |

|---|---|---|

| EBITDA | 823,277 | 358,508 |

| ROCE | 19.7% | 10.5% |

| ROE | 21.9% | 10.5% |

| EVA | 406,778 | 203,422 |

| ROCE Calculation 2022 | |

|---|---|

| Amounts in € mio. | 2022 |

| EBIT(A) | 734 |

| Equity attributable to parent’s shareholders (B) | 2,130 |

| Non Current Debt Liabilities (C) | 1,602 |

| ROCE [Α / (Β+C)] | 19.70% |

| EVA Calculation 2022 | |

|---|---|

| ROCE(A) | 19.70% |

| WACC(B) | 8.77% |

| Capital Employeed (C) | 3,732 |

| EVA [(A-B)*(C)] | 406,778 |