Enterprise risk management

1. Risk Governance

Enterprise Risk Management is an essential component of MYTILINEOS’ operations and is achieved through a multidimensional approach which is based on three fundamental elements: Risk Governance, Risk Culture and our Enterprise Risk Management framework. Through these elements, we achieve a comprehensive approach to the management of risks that affect our strategy, operations, and business objectives.

MYTILINEOS has developed a robust risk governance framework aiming to support the business objectives, develop a common risk language and enhance decision making by clearly defining the context of risk management responsibilities.

1.1 Three Lines Model:

By adapting and implementing the three lines model, MYTILINEOS has defined appropriate structures and roles in managing risk related matters that facilitate strong governance and risk management.

The first line consists of Risk and Control Owners across our organization (the General Divisions and Business Units), who are responsible for the identification, assessment, management and monitoring of risks. In its role, the first line, is also supported by Risk Partners who provide guidance and oversee the implementation of risk management practices designed by the ERM Division. With the establishments of ERM Division, as a second line function, is supported and challenges the first line by coordinating the implementation of risk management practices and providing expertise and guidance regarding the severity of risks. The third line, our Internal Audit Division, is responsible for providing independent and objective assurance over the adequacy and effectiveness of governance, risk management and internal controls.

1.2 Risk Governance Structure:

A sound risk governance structure is an essential component in the development of a framework for the identification, assessment, acceptance and rejection of risks, while pursuing the achievement of the organizational objectives.

Moreover, the risk governance structure establishes the tone at the top that serves as the foundation for an effective risk management framework, provides oversight, clear messaging, regular leadership dialogue and defines roles, responsibilities as well as reporting lines.

The framework described below presents the key components of MYTILINEOS’ risk governance structure:

Board of Directors

The Board has overall responsibility and exercises oversight for risk management. It establishes the risk appetite, monitors key risks, considers risks that affect strategy and leverages risk information into the decision-making process. Moreover, the Board approves the ERM Policy of MYTILINEOS through the Audit Committee.

Audit Committee

The Audit Committee supports the Board in monitoring the effectiveness of risk management and the internal control system by reporting on key risks and the progress of mitigation plans, on a periodic basis.

ERM Division

ERM periodically reports to the Audit Committee, the most significant risk exposures and trends as well as the progress of action plans.

Additionally, ERM designs, maintains and deploys the overall risk management framework across the organization, monitors adherence to the framework, collects risks across the General Divisions and Business Units, performs aggregated risk reporting and escalates risk and control related matters to Senior Management.

Internal Audit & Compliance Divisions

The Internal Audit function provides independent assurance, while the Compliance function is responsible for monitoring specific risks. Moreover, monthly meetings are held amongst ERM, Internal Audit and Compliance functions to promote collaboration, facilitate the alignment of risk related activities, expand risk coverage, increase efficiency, monitor action plans, protect and create value for the business.

Risk Partners

Responsible to coordinate and support the risk identification / assessment process and to monitor the implementation of risk mitigation plans.

Process Owners

Responsible for the effective and efficient implementation of business processes.

Risk Owners

Responsible to manage the identified risks and oversee the risk mitigation actions.

Control Owners

Responsible to ensure that the controls in place are operating as intended.

1. Risk Culture

MYTILINEOS promotes a risk culture to support informed decision-making across the organization through various initiatives.

The Board establishes the appropriate risk behaviors through the provisions, communication, and acceptance of Code of Conduct Principles by all personnel.

Roles and responsibilities for risk management are clearly articulated and understood from risk management participants and risk transparency is enabled by comprehensive risk reporting, including the analysis of inherent and residual risk levels and aggregated views of risks. In addition, the qualitative and quantitative risk appetite statements are approved by the Board and are a key component of our risk management framework. The risk appetite is aligned to our strategy and stakeholders’ perspectives and provides guidance to management regarding the types and level of risk that the organization is willing to pursue to achieve its business objectives and maximize shareholder value.

Moreover, the ERM Division has developed formal processes which are available to all employees through MYTILINEOS’ intranet and establish communication lines amongst the ERM Head, the Risk Partners and the Risk Owners. Through these communication lines, involved parties are able to propose new risks, reassess existing risks, discuss risk and control concerns and share ideas to enhance the overall risk management process and practices. Furthermore, common risk terminologies, categories and ratings are established between the ERM and Internal Audit Divisions to enhance the alignment of assurance functions, establish a common risk language and provide Executive and Senior Management with a clear and fair view of risks and their impact on the organization.

Moreover, the Internal Audit Division leverages the work of the ERM Division in order to prioritize the auditable units, assess the design and effectiveness of related controls and provide Executive and Senior Management of MYTILINEOS with an overall assessment of the internal control system. Additionally, in order to embed a risk culture across the organization, the ERM Head conducts training sessions for risk management participants (e.g., Risk Partners, Risk Owners etc.) about the concepts of risks and controls. The aim of these training sessions is to increase the participants’ awareness regarding the importance of risk management practices as a tool to achieve the organizational objectives, to identify areas of improvement and to strengthen the management of risks.

For the onboarding of new employees, training material is adjusted as needed to include risk matters related to current/emerging topics (e.g., GDPR, Security) that may arise and should be brought to the attention of new joiners. For the assessment of new projects/contracts with significant risk exposure, MYTILINEOS has developed a process for the evaluation of the associated risk impacts to examine the projects/contracts’ viability. MYTILINEOS has developed a platform with predefined fields and approval stages to support the effective implementation of the process. In addition, MYTILINEOS initiated and completed an initiative to strengthen the internal control system of its Central Functions and Business Units and increase the awareness of personnel in the concepts of risks and controls. The initiative resulted in the documentation of major processes, risks, and controls for the Central Functions and the documentation of Entity Level Controls and corresponding risks for the Business Units. Finally, the internal control system of the Central Functions and Business Units was assessed based on the principles of the COSO 2013 Internal Control-Integrated Framework.

2. ERM Framework

Our ERM Framework aims to establish a streamlined process for the identification, assessment and eporting of risks that includes defined roles and responsibilities,risk terminology, assessment criteria, tools for the documentation of risks and escalation and reporting lines.

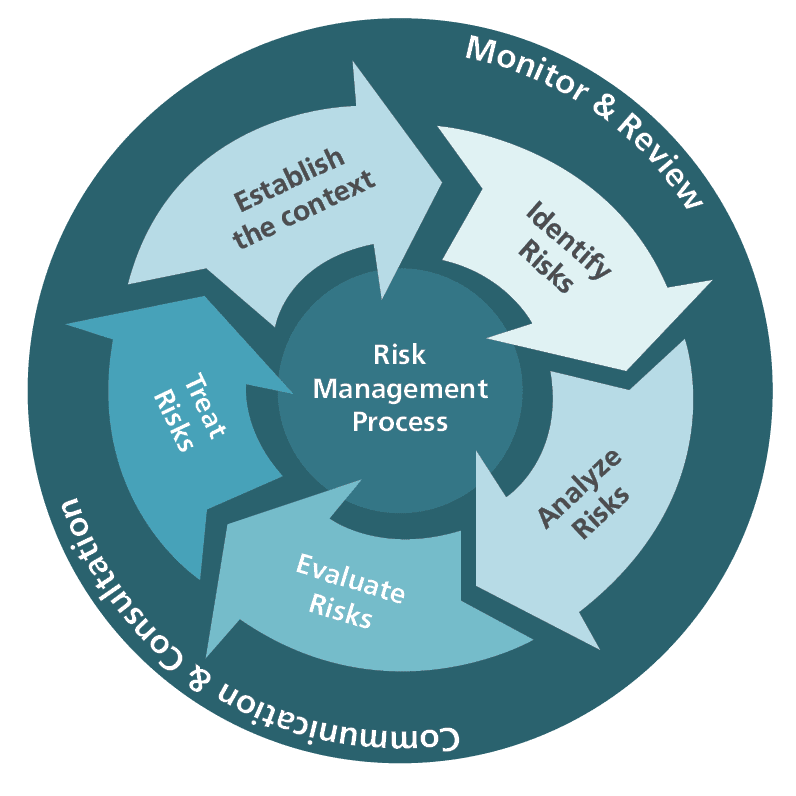

2.1 Our ERM Process

Our ERM process has been developed with the aim to fit the structure and objectives of MYTILINEOS. The process incorporates elements and principles of ISO 31000 and COSO ERM to establish a strong and dynamic risk management framework that consists of the following elements:

Establishment of Context: Establishing the context helps in understanding the organization’s internal and external environment and defining the set of criteria against which the identified risks will be assessed / measured.

Risk Identification: Through the identification of risks, we recognize areas of uncertainty and potential events that could affect the achievement of the organization’s goals. MYTILINEOS conducts the risk identification through various methods and assigns each risk to a Risk Owner to promote and ensure accountability.

Risk Analysis & Assessment: The identified risks are analyzed and assessed in terms of inherent and residual risk.

Risk Treatment: MYTILINEOS determines the appropriate risk response to effectively manage its risk exposure according to the organization’s risk appetite as well as the level of the risk rating of each identified risk.

Monitoring and Review: MYTILINEOS analyzes risk trends and monitors the status of risk mitigation plans. Furthermore, we assess and monitor the performance of the ERM Framework to identify potential improvement opportunities.

Communication and Consultation: MYTILINEOS plans and implements communication activities related to the ERM Framework aiming to maintain open and dynamic communication with Risk Partners and Risk Owners as well as frequent reporting to Senior Management and the Audit Committee.

2.2 Our Risk Universe

The identified risks are classified into five (5) categories Strategic, Market, Operational, Financial, Legal & Regulatory & Compliance, as presented below.

Strategic

Risks that may offer benefits to the organization or threats that may arise from adverse business decisions, poor implementation and execution of the organization’s strategy, or lack of responsiveness to strategic plan deviations caused by external or internal factors.

Market

Risks that may arise from failure to identify factors relating to macroeconomic and sociopolitical conditions that will affect the ability of the organization to maintain or increase its revenue and profitability in a specific business environment.

Financial

Risks that may arise due to ineffective management of financial markets’ volatility and incorrectly, miscalculated, omitted, or misrepresented financial information to external users such as investors and regulators, or internal stakeholders.

Operational

Risks that may arise from inadequate or failed internal processes or systems, or ineffective human resource management, or from external events.

Legal & Regulatory & Compliance

Risks that may arise from ineffectively managing regulatory and legal risks and failure to comply with internal procedures resulting in regulatory censure, adverse financial or reputational impact.

3. Emerging Risks

MYTILINEOS identifies and monitors emerging risks through various channels such as Management Committees and reports from specialized consultants on new trends and risks. Moreover, risks that are already identified and captured through the treamlined risk management processes and could possibly have a high impact for the organization in the long-term, are considered as emerging risks that require attention and close monitoring from the ERM Head and Senior Management.

Long-term resources availability

Inadequate and/or inefficient monitoring and knowledge of the reserves and availability of critical materials may lead to inability to meet client expectations, increased production costs and failure to capture the benefits of new synergies and/or technologies that may eventually adversely impact MYTILINEOS’ financial performance, client satisfaction and reputation.

Mitigation

MYTILINEOS finances long — term investments according to its strategy (e.g., PV plants construction, CCGT power plant — IPP 2). Additionally, MYTILINEOS continuously monitors the reserves and availability of critical materials through monthly meetings of he BU Committees (Metallurgy, Power, SES, RSD) and the Energy Committee where relevant developments regarding reserves nd resource availability are presented and discussed.

Furthermore, MYTILINEOS estimates its reserves and needs of critical raw materials in order to find alternative options if needed in the future.

Finally, MYTILINEOS enters into long-term gas/electricity supply agreements with counterparties that meet the organization’s criteria regarding reliability and creditworthiness to ensure availability of critical materials for its activities.

Climate Change & Business Transition

The risk is related to the potential failure of the organization to monitor and adjust its business operations and strategy to sustainability principles and climate change.

Inefficiencies in monitoring and adjusting to extensive changes in the policies, laws, and technologies concerning the measures for adapting to and mitigating climate change may have an impact on the operations of Business Units and the achievement of MYTILINEOS’ financial, business and sustainability targets and thus on its long-term growth.

Mitigation

MYTILINEOS is greatly committed to tackling climate change and addressing energy transition. MYTILINEOS’ approach is based on the following actions:

(a) reducing emissions and achieving a net zero footprint,

(b) supporting the national energy transition,

(c) boosting investments in RES,

(d) creating low-emission products and services,

(e) electrification,

(f) research and innovation.

4. Principal Risks

The identified principal risks can materially and adversely affect our future performance, strategy and reputation. Through our robust risk management framework, a detailed understanding of the exposures faced by the organization is achieved. The principal risks are timely identified and closely monitored and analyzed so that appropriate mitigation actions, in line with our risk appetite, can be taken. An analysis of the principal risks that MYTILINEOS faces including the description and potential threats of each risk, the root causes/factors that contribute to the materialization of the risk, MYTILINEOS’ appetite for each risk and related mitigation actions are presented below.

Geopolitical

Social, political factors or trade barriers within a market environment may affect the organization’s investments and ability to market, sell and provide products and services. Through its business activities that expand in five continents, MYTILINEOS is exposed to a wide and everchanging geopolitical environment that could potentially threaten the organization’s activities and reputation.

MYTILINEOS’ activities, access to markets or operational continuity may be disrupted due to political instability, including terrorism, war, crime and social unrest. Furthermore, increased changes in policies, regulations and legislations could potentially impact key markets for MYTILINEOS’ products, projects and services. Finally, political disputes between major economies threat and impact global supply chains and cause uncertainty over future business conditions that could eventually result in less informed investment decisions.

Root Causes/Factors

i. Strategic, political, and economic interests of countries and changes in their governments and policies.

ii. Political instability in countries that the organization operates.

iii. Sanctions, restrictions in countries where the organization operates and/or invests.

iv. Failure to assess the risk of entering into new markets.

v. Inability to be proactive and identify, manage and react to changing policies & regulations that may affect the business operations.

vi. Failure to lobby against adverse regulatory and legislative agendas.

Appetite

We have activities in various countries with less stable political and economic environment, and possible restrictions imposed after the initiation of projects / investments. We are willing to accept medium levels of Geopolitical Risk in pursuit of our strategic objectives and stakeholders’ expectations, maximizing the shareholder value and ensuring, in any case, that we monitor and assess the factors that may impact our risk exposure and respond efficiently, where possible.

Mitigation

MYTILINEOS has developed specific policies and processes for the assessment of the Geopolitical Risk exposure but also for the implementation of risk mitigation plans. More specifically, MYTILINEOS deploys the following instruments/tools:

i. In-house comprehensive Geopolitical risk assessment

ii. Legal pre-contractual assessment

iii. Ensuring favorable contractual terms

iv. Financial and insurance instruments

v. Safety and security measures for personnel and premises.

MYTILINEOS continuously monitors and assesses the geopolitical environment of each country it has operations, in terms of security, political stability and regulations, to identify any emerging geopolitical risks and/or monitor the development of existing ones.

Moreover, MYTILINEOS conducts thorough review of the geopolitical environment and accompanied risks when considering expanding its activities in new countries. More specifically, multidivisional working groups are formed, which in collaboration with specialized consultants, assess the type and severity of the risks that MYTILINEOS may be exposed to (political, credit, health & safety, tax, supply chain, etc.). As part of the assessment, local visits may be conducted to countries of interest to further examine the expansion opportunities. The assessment is followed by the development of corresponding risk management strategies that are evaluated in relation to the benefits presented by the expansion of activities to arrive to an informed decision that considers the Geopolitical Risks involved.

MYTILINEOS has developed a strategy for actively engaging with key stakeholders in the countries the organization operates, such as governments and regulators, aiming to achieve continuous monitoring of the situation in each country and assist in the socio-economic development of the countries through various initiatives.

Macroeconomic

Macroeconomic Risk is associated with potential failure to plan for or manage fluctuating macroeconomic factors (e.g., inflation, GDP, economic growth, stability, unemployment rate) and could lead to financial loss.

Through its business activities that expand in various economies, MYTILINEOS is exposed to a wide range of macroeconomic trends and factors that could potentially threaten the organization’s activities and financial viability/stability.

More specifically, MYTILINEOS could face negative impacts due to significant reduction in customer spending or delays of investment plans, inflationary pressures that affect the underlying cost base and margins, political instability and aggressive monetary and/or fiscal policies that may adversely affect the organizational objectives.

Root Causes/Factors

i. Local and national political changes.

ii. Inability to monitor and assess the organization’s exposure to domestic and global economic developments, e.g., recessions, unemployment rates, and downturns in production or demand.

iii. Failure to assess country factors that may affect the decision-making process such as political stability, economic stability, tax implications, banking adequacy, foreign exchange risk, legal system, etc.

Appetite

We are exposed to dynamic domestic and global macro-economic factors, and we operate in possible high-risk countries. We are willing to accept medium levels of Macroeconomic Risk, ensuring, in any case, that we assess and monitor the factors that may impact our financial position and respond efficiently, where possible.

Mitigation

MYTILINEOS primarily operates across various geographies, economies and industries (Power & Gas, Metallurgy, Construction, Renewables), thus has a balanced portfolio that ensures resilience and future profitability, since the organization is less exposed to adverse economic developments in a single geography or industry.

MYTILINEOS continuously monitors the macroeconomic environment through monthly meetings of the BU Committees (Metallurgy, Power, SES, RSD) and the Energy Committee where relevant developments are presented and discussed.

MYTILINEOS monitors, through various channels, the current and estimated developments in the market, the macroeconomic variables and the accompanied macroeconomic risks (e.g., macroeconomic stability of a country, inflation fluctuations, monetary policies), that could potentially create the need to adapt the organization’s actions both in production and investment levels.

Furthermore, MYTILINEOS integrates macroeconomic metrics and forecasts in its five-year business plan to examine the viability of projects and future opportunities against a range of associated variables (e.g., prices, costs).

Energy Supply

MYTILINEOS’ operations could potentially be at risk due to high energy prices and availability constraints caused by disruptions in the energy market.

Potential failure to effectively plan and manage the energy sources (electrical power, natural gas etc.) in terms of quantity, pricing and costs, could result in production delays and disruptions, additional costs and inability to meet operational, financial targets and client needs.

Root Causes/Factors

i. Fluctuations in regional/global supply/demand of natural gas.

ii. Gas supply chain capacity shortages affecting plant production.

iii. Inability to source competitive electrical power mix.

iv. Inability to source competitive natural gas.

v. Lack of monitoring activities to capture changes in the natural gas/power market.

Appetite

We seek to ensure effective management of energy sources, taking into consideration external factors such as fluctuations in regional/global supply/demand of natural gas and power.

Our appetite for Energy Supply Risk is medium, ensuring in any case that we assess and monitor the factors that may impact our exposure to risk and respond efficiently, where possible.

Mitigation

The Energy Committee of MYTILINEOS continuously monitors energy sources (electrical power, natural gas etc.) in terms of quantity, pricing and costs. The Energy Committee meets regularly to analyze the latest developments in the energy sector and how they impact the organization.

MYTILINEOS enters into long-term gas/electricity supply agreements with counterparties that meet the organization’s criteria regarding reliability and creditworthiness to ensure availability of critical material for its activities.

Finally, where feasible, MYTILINEOS hedges the energy prices’ fluctuation both with strategic and operational methods, using various financial instruments, such as derivatives.

Commercial and Competition

The rapidly evolving market landscape and technological advancements have created a highly competitive global economy, in which the actions of existing and new competitors could threaten MYTILINEOS’ ability to achieve its strategic objectives.

Potential failure of the organization to act on changing market conditions and to establish a business development and promotion strategy could lead to the loss of market share and customers, decline of revenue and/or decrease of profit margins and thus adversely impact the overall financial targets and profitability of MYTILINEOS.

Root Causes/Factors

i. Ineffective customer relationship management and poor customer service.

ii. Inability to identify target client base.

iii. Inability to effectively analyze the business environment and market demands.

iv. Failure to identify new products / services / technologies that are innovative and result in an appropriate return on investment.

v. Inability to monitor customer satisfaction.

vi. Failure to identify evolving client preferences.

Appetite

Our appetite for Commercial & Competition Risk is medium taking into consideration the challenging environment in the energy, metallurgy and construction industry, safeguarding in any case our competitive advantage with a variety of assessment and monitoring tools.

Mitigation

MYTILINEOS operates in demanding local and international markets, with creativity, efficiency and respect for the environment, the society and the competition.

Therefore, the management of this risk is a priority for Management, which constantly examines the operating environment and adopts best practices and technologies, while investing in research and development that will give a competitive advantage and will allow for an increase in the customer base, profitability, and profit margins.

Also, Management periodically reviews the organizational/operating model, which is carefully adjusted, as needed, through structural changes that reflect the strategic objectives and evolving market expectations and trends.

Furthermore, MYTILINEOS through its business development strategy identifies and pursuits the development opportunities and improves its business relations with partners and customers.

Finally, through the vertically integrated production, trading and supply of power and gas, the independent natural gas import, and the prioritization and safeguarding of the quality of products and services, MYTILINEOS maintains its competitive advantage across the industries and markets in which it operates.

Investment Decisions

Potential failure to identify and assess business opportunities or threats that align with the organization’s strategic objectives and are related to business portfolio growth (such as mergers, acquisitions, divestments, joint ventures and strategic partnerships) could impact MYTILINEOS’ market share and growth rates and eventually lead to decreased earnings and competitive disadvantages.

Root Causes/Factors

i. The strategic plan is not based on accurate, current, and realistic information.

ii. Potential failure to meet business objectives due to the absence of a clear vision and/or supporting strategy.

iii. Not well-defined decision-making process for the organization to decide whether to invest/grow or divest/liquidate.

iv. Lack of availability of data and reliable models to perform valuation and pricing.

v. Unrealistic assumptions during the due diligence process.

Appetite

It is our priority to identify business opportunities that align with our strategic objectives achieving financial growth with potential high return.

We have medium appetite for Investment Decisions Risk, ensuring in any case that we effectively assess the growth and investment opportunities.

Mitigation

MYTILINEOS identifies and assesses growth or investment opportunities aligned with its strategic objectives through a multi-dimensional approach. MYTILINEOS has established processes and channels (internal and external) for the identification, review and analysis of investment opportunities.

The Strategy and M&A General Division in cooperation with the involved Business Units and the related central functions and external consultants, if necessary, analyze the available data. For the effective execution of transactions, MYTILINEOS establishes Transaction Working Groups, to monitor the workstreams involved in each transaction.

Furthermore, MYTILINEOS conducts a formal due diligence process, involving the review and assessment of legal, tax, financial, technical, environmental, insurance, social and human resources data, all included in a specialized risk matrix (risk identification & management).

Moreover, MYTILINEOS has developed and established an approval process for projects and contracts with significant risk exposure for the organization, that ensures careful consideration and proper assessment of the different risk elements and opportunities. Such projects/contracts are identified based on defined criteria and require thorough review through a three-step approach.

Health & Safety

Through its global operations, MYTILINEOS is exposed to health and safety related risks (minor accidents, accidents with work time loss, occupational diseases and fatalities).

We operate in hazardous industrial sites and execute complex projects which require adherence to strict health and safety rules and regulations.

Potential failure to effectively manage health and safety related matters could potentially affect the physical and mental health of our employees, subcontractors, business partners and members of the public and thus lead to litigations, fines, insurance costs and reputational damage and subsequently to the loss of future business opportunities.

In addition, health and safety incidents could impact employee satisfaction and lead to business disruptions.

Root Causes/Factors

i. Poor monitoring and evaluation of healthy working conditions.

ii. Lack of specialized and trained personnel involved.

iii. Lack of policies and procedures regarding Health & Safety management.

iv. Lack of monitoring activities to ensure the implementation of the safety procedures.

v. Violations of standards of practice and behavior as set forth by Health and Safety rules and regulations.

vi. Lack of responsibility, and accountability in handling Health & Safety incidents.

Appetite

Our appetite for Health & Safety Risk is very low. It is essential for us to ensure health and safety in every workplace we operate.

Mitigation

Occupational health and safety has always been fundamental to the operation of MYTILINEOS and is considered a primary business objective. To manage the Health and Safety Risk, MYTILINEOS monitors and addresses health and safety issues and underlines the importance of health and safety as the No. 1 item of all Business Committees.

MYTILINEOS acknowledges its responsibility and actively seeks to ensure the best possible health & safety conditions in all its work areas, through the implementation of an integrated and certified Occupational Health & Safety Management System. Additionally, MYTILINEOS, to ensure compliance with the applicable legislations, has established and implements strict health and safety policies and procedures throughout the organization, that support MYTILINEOS’ objective for health and safety. Through the implementation of the System, policies and procedures in place, MYTILINEOS adopts appropriate measures for preventing accidents and occupational diseases, conducts audits, accident investigation and analysis activities as well as close monitoring and reporting of matters related to health and safety.

Additionally, MYTILINEOS provides ongoing health and safety training programs to all employees aiming to promote and embed a safe work culture. The training programs are adjusted to fit the specialized training needs of employees based on the work they perform.

Finally, MYTILINEOS has established and is strictly implementing security systems and safety measurements to assess the health and safety impact of its operations on employees and to identify any need for interventions in all its work areas (offices and industrial facilities).

Commodities

MYTILINEOS operates in global markets and is exposed to commodity price fluctuations that are market driven.

Potential failure to plan or manage unfavorable fluctuations in commodity prices could adversely impact MYTILINEOS’ future financial performance.

More specifically, through its business activities, MYTILINEOS is mainly exposed to risks arising from price fluctuations in Aluminium (AL), Aluminium Oxide (OX) and raw materials, from price fluctuations in natural gas as well as from emission allowances, scrap aluminium and natural gas sourcing activities.

This kind of exposure could negatively affect both revenues (e.g., metal prices at LME) and costs (e.g., natural gas prices).

Root Causes/Factors

i. Lack of technical knowledge and expertise to manage commodities’ risk.

ii. Lack of monitoring activities to capture and manage unfavorable market, regulation, and country changes/events that may affect the volatility of commodities’ prices.

iii. Lack of defined policies to provide guidance for handling commodities’ prices.

iv. Lack of access to market information/databases to effectively manage unfavorable changes to commodities’ prices.

Appetite

We are exposed to the volatility of specific commodities and important raw materials and services prices (e.g. Aluminium, Alumina, Natural gas), which are influenced by external factors such as global economic conditions, supply and demand. We are willing to accept medium levels of Commodities Risk ensuring that this risk is efficiently and effectively managed, implementing proactive measures such as hedging.

Mitigation

MYTILINEOS maintains a diverse portfolio of commodities, assets, liabilities and currencies across several geographies as well as a varied portfolio of customers and contracts that ensures resilience and future profitability since the organization is less exposed to adverse developments in a single market.

Moreover, MYTILINEOS continuously monitors, through various channels, the current and estimated developments in the commodity markets that could potentially create the need to adapt the organization’s overall commodities’ management.

MYTILINEOS aims to manage the effects commodity price fluctuations could have on its revenues and costs through hedging activities using various financial instruments. More specifically, the Treasury Division hedges commodity price fluctuations based on annual forecasts and management’s directions and targets. MYTILINEOS ensures that hedging activities are conducted properly through Financial Risk Management processes that outline appropriate approval flows, communication lines, open position monitoring activities, reconciliation activities and transaction counterparty management.

The Treasury Division presents monthly any new developments in commodity markets, new hedging strategies and a summary of current positions to MYTILINEOS’ Financial Committee.

Credit

Credit Risk entails the potential failure to effectively manage credit incidents.

MYTILINEOS is exposed to Credit Risk through the possibility of a counterparty default, a credit rating downgrade and/or an adverse credit environment in general. Such an event could lead to increased spreads, unfavorable prepayment obligations and borrowing terms for MYTILINEOS.

Furthermore, Credit Risk could be realized through an inability to efficiently collect receivables that would cause significant bad debt expense and/or excessive days receivables outstanding.

If any factors of Credit Risk were to materialize, MYTILINEOS’ financial condition, revenues and cashflows could be negatively impacted.

Root Causes/Factors

i. The organization may not comply with agreed funding agreement terms, like financial covenants, representations, undertakings, cross-default clauses, limitations in disposals, M&As, distributions, etc.

ii. Lack or improper aging process.

iii. Lack of effective credit management and collections policies and procedures.

iv. Lack of certain limits and criteria (e.g., credit rating) regarding the exposure of the organization on each counterparty.

v. Inadequate monitoring of client balances (accounts receivables).

vi. High volume/amount and/or long due of outstanding clients’ balances.

Appetite

We are subject to events such as default of customer, credit rating downgrade and adverse credit market conditions. We are willing to accept medium levels of Credit Risk, engaging with customers and counterparties established in various countries, in pursuit of our strategic objectives, in light of our policies and procedures.

Mitigation

MYTILINEOS secures its access to sufficient debt funding sources and builds strong relationships with lending institutions to meet future obligations and manages effectively assets, liabilities and capital requirements.

Furthermore, MYTILINEOS has Credit Risk policies and processes in place that guarantee transactions only with clients that are characterized by appropriate creditworthiness. These policies are accompanied by strict client selection criteria and by constant monitoring of the credit granted to them.

Moreover, Credit Risk is also managed/mitigated through credit insurance policies with global insurance companies, receivables in advance to a considerable degree, safeguarding claims by collateral loans on customer reserves, receiving letters of guarantee and quantitative and qualitative limits on cash reserves and cash equivalents, derivatives, as well as other short term financial products.

The tables below summarize the maturity profile of the Group’s financial assets as at 31.12.2022 and 31.12.2021 respectively:

| MYTILINEOS GROUP | ||||||

|---|---|---|---|---|---|---|

| Past due | Non past due | Total | ||||

| (Amounts in thousands €) | 0-3 months | 3-6 months | 6-12 months | > 1 year | ||

| Liquidity Risk Analysis — Trade Receivables | ||||||

| 2022 | 150,504 | 64,074 | 57,096 | 24,887 | 1,154,681 | 1,451,240 |

| 2021 | 280,256 | 22,268 | 1,363 | 18,282 | 1,031,274 | 1,353,444 |

| MYTILINEOS S.A. | ||||||

|---|---|---|---|---|---|---|

| Past due | Non past due | Total | ||||

| (Amounts in thousands €) | 0-3 months | 3-6 months | 6-12 months | > 1 year | ||

| Liquidity Risk Analysis — Trade Receivables | ||||||

| 2022 | 131,676 | 62,290 | 20,261 | 18,699 | 713,349 | 946,274 |

| 2021 | 74,582 | 22,698 | 896 | 14,816 | 628,535 | 741,525 |

The below table shows the Group exposure in credit risk.

| MYTILINEOS GROUP | |||||

|---|---|---|---|---|---|

| 2022 (Amounts in thousands €) | Gross Trade Receivables | Expected credit loss | Net trade receivables | Average percentage of expected credit loss | |

| Non past due | 1,155,994 | 1,313 | 1,154,681 | 0.11% | |

| Past due less than 3 months | 151,697 | 1,193 | 150,504 | 0.79% | |

| Past due 3-6 months | 65,173 | 1,099 | 64,074 | 1.69% | |

| Past due 6-12 months | 69,279 | 12,183 | 57,096 | 17.59% | |

| Past due > 1 year | 53,982 | 29,095 | 24,887 | 53.90% | |

| Total | 1,496,125 | 44,883 | 1,451,241 | 3.00% | |

| MYTILINEOS GROUP | |||||

|---|---|---|---|---|---|

| 2021 (Amounts in thousands €) | Gross Trade Receivables | Expected credit loss | Net trade receivables | Average percentage of expected credit loss | |

| Non past due | 1,032,103 | 829 | 1,031,274 | 0.08% | |

| Past due less than 3 months | 282,377 | 2,121 | 280,256 | 0.75% | |

| Past due 3-6 months | 23,984 | 1,716 | 22,268 | 7.15% | |

| Past due 6-12 months | 2,092 | 729 | 1,363 | 34.84% | |

| Past due > 1 year | 41,983 | 23,701 | 18,282 | 56.45% | |

| Total | 1,382,539 | 29,095 | 1,353,444 | 2.10% | |

The below analysis of the balance of the Group’s trade receivables on 31/12/2022 (per nature of trade receivable item) as well as the simple average collection days (DSO, based on the annual Turnover) is shown in the following table:

| Group | |||

|---|---|---|---|

| amount in k. € | 2022 | 2021 | |

| T.R. | Trade Receivables | 1,451,241 | 1,353,444 |

| Out of which: | |||

| (a) | Related to advances given to Trade Creditors | 205,532 | 161,650 |

| Advances received from Customers in liabilities | -507,857 | -46,431 | |

| (b) | Related to Revenue recognition (not yet invoiced) | 239,843 | 278,070 |

| Liabilities for invoiced but not yet recognised as revenue receivablees | -215,551 | -194,724 | |

| (c) | Related to payables (no offseting performed) | - | 174,054 |

| (d) | Related to EPC financing (secure) | 11,322 | 185,834 |

| Net Trade receivables (recurring basis), T.R. — a-b-c-d | 994,544 | 553,835 | |

| TURNOVER | 6,306,472 | 2,664,050 | |

| Simple calculated DSO (w/o VAT adjustments) | 57.6 | 75.9 | |

Foreign Exchange

Through its business activities that expand in various countries, MYTILINEOS is exposed to Foreign Exchange Risk.

Failure to manage foreign exchange exposures, such as contracts in which the cash inflow and the cash outflow are in different currencies or unfavorable fluctuations in the currency of another market, could lead to financial loss.

More specifically, MYTILINEOS’ foreign exchange exposure arises mainly from the US dollar and originates from commercial transactions in foreign currency and from net investments in foreign financial entities, therefore changes in foreign exchange rates could adversely impact cash flows, costs, project profitability and eventually shareholder returns.

Root Causes/Factors

i. Potential collapse of the currency in countries where business is conducted will expose the organization to loss.

ii. Lack of technical knowledge and expertise to manage Foreign Exchange Risk.

iii. Lack of monitoring activities to capture and manage unfavorable market, regulation, and country changes/events that may affect the volatility of foreign exchange rates.

iv. Inability to identify foreign exchange exposures derived from contracts where Cash inflow and Cash outflow are in different currencies.

Appetite

We are exposed to fluctuations in exchange rates (mainly USD) during business operations, including sales/purchases of aluminum and alumina, EPC contracts, natural gas. Our appetite for Foreign Exchange Risk is medium and where possible foreign exchange exposure is hedged.

Mitigation

MYTILINEOS aims to manage the effects foreign exchange exposures could have on its revenues and costs through hedging activities, using various financial instruments. More specifically, the Treasury Division performs foreign exchange hedging for specific assets, liabilities or future commercial transactions based on annual forecasts and management’s directions and targets. MYTILINEOS ensures that hedging activities are conducted properly through Financial Risk Management processes that outline appropriate approval flows, communication lines, open position monitoring activities, reconciliation activities and transaction counterparty management. The Treasury Division presents monthly any new developments, that impact the organization’s foreign exchange exposure, new hedging strategies and a summary of current positions to MYTILINEOS’ Financial Committee.

Supply Chain Management

MYTILINEOS’ operations rely on the availability of raw material resources and are enabled by numerous suppliers and external partners, thus exposing the organization to the Supply Chain Risk.

Potential failure to effectively/efficiently manage the raw material resources availability and to implement an effective and comprehensive framework for the selection of suitable suppliers and external partners could lead to disruptions in the supply chain and business operations and thus impact the reputation of MYTILINEOS and its relations with business partners and clients.

Moreover, such disruptions and mismanagement could impact the operational efficiency, overall execution of projects and financial results and even lead to litigations and fines.

Root Causes/Factors

i. Inadequate procurement planning.

ii. Lack of sufficient evaluation and assessment criteria during the supplier selection process.

iii. Ineffective monitoring and evaluation of supplier performance.

iv. Inability of the supplier to comply with the sustainable development practices of the organization.

v. Over-reliance on a vendor may lead to supply chain disruption.

vi. Insufficient inventory levels of critical raw materials, fuels and critical spare parts for the continuation of business operations.

Appetite

We have medium appetite for Supply Chain Management Risk, taking into consideration supply chain constraints and disruptions in the market, as well as our goal for efficient and effective management of raw material resources availability and suppliers.

Mitigation

MYTILINEOS seeks to develop strong and long-term relationships of trust and mutual benefit with its suppliers and external partners. To achieve this objective, MYTILINEOS has developed and implements internal policies and procedures that define supply management operations as well as procurement planning and include approval rights, dedicated decision-making committees as well as roles and responsibilities of the involved parties.

According to the established processes, suppliers and subcontractors are subject to due diligence and are assessed based on defined criteria as well as on the ESG operating model, prior to any business agreement. Such criteria include their financial, quality and time credibility, the cost of the provided services/products and their ability to meet the supply needs with the appropriate quality according to specifications defined by MYTILINEOS’ Business Units.

On a yearly basis, suppliers, subcontractors and external partners are assessed based on their performance to ensure future reliable collaborations with high-performing partners. Additionally, MYTILINEOS has designed a dedicated supplier evaluation questionnaire with ESG criteria, reenforcing the overall direction of the organization towards sustainability and transparency.

To address possible issues such as misconduct and unethical behaviors, MYTILINEOS has developed a dedicated «Suppliers & Business partners Code of Conduct». The Code includes the description of the minimum conditions / expectations of MYTILINEOS from its supply chain partners, in matters related to responsible entrepreneurship and sustainable development while it is a basic condition of the commercial cooperation of the two parties.

Additionally, inventory is monitored on a periodic basis and in some cases, mainly for critical materials, safety stock levels are established to ensure stock availability.

People

People Risk entails potential failure to attract, recruit and retain human resources or potential failure to create positive working environment due to lack of effective communication with employees or to ensure the continuation of critical operations due to insufficient succession planning.

If this risk were to materialize, it could adversely impact the success of MYTILINEOS’ strategic objectives and threaten its reputation and the timely achievement of its commitments.

Moreover, low levels of employee engagement and/or relatively high employee turnover rates could lead to a loss of «know-how» and skills and eventually to business disruptions and a reduced confidence within the market and among stakeholders.

Root Causes/Factors

i. Inequalities in terms of pay, education and training, as well as in terms of the opportunities for the advancement and development of human resources.

ii. Inability to identify, develop and implement effective succession plans.

iii. Failure to attract, hire and retain talents who possess the skills, knowledge, competencies, and experiences needed.

iv. Failure of the organization to manage the labor relationships effectively and uniformly.

v. Employees are not properly trained to perform their job responsibilities.

vi. Employee performance is not measured, evaluated and rewarded properly.

vii. Compensation and benefits programs do not support the organization’s business objectives.

Appetite

We have low appetite for People Risk. Our human capital is essential, and it is our priority to attract, hire and retain the appropriate talents, to ensure a desirable working environment and an effective labor relationship framework, as well as to identify and develop future leaders.

Mitigation

MYTILINEOS aims to provide a positive working environment that enables the development of its employees. To achieve this objective and mitigate its People Risk, MYTILINEOS has adopted the following:

i. Defined Human Resources Policies and Procedures.

ii. The identification of critical positions within the organization and the development of the corresponding succession plans.

iii. Recruitment practices that ensure the selection of suitable and competent executives through meritocracy and equal treatment.

iv. The development of programs for formulating a uniform corporate culture that is present across all levels of the workforce and acts as the element that ensures cohesion and consensus in the efforts to realize MYTILINEOS’ vision.

v. The implementation of employee training and development programs aimed at strengthening personal and technical skills and capabilities.

vi. The implementation of the year-long graduate programs, which give the opportunity to young people to receive training in real working conditions and acquire working experience through their participation in complex and demanding MYTILINEOS projects.

vii. The provision of incentives, in terms of compensation and benefits as well as in terms of opportunities for advancement and development, aimed at increasing the employees’ commitment and retention.

viii. Regular performance reviews and feedback to enable employee development and growth.

ix. Commitment to gender and generational balance and focus on offering local opportunities.

x. Promotion of the Code of Business Conduct to all personnel and ensuring employee awareness, and avoidance of direct or indirect discrimination in all work practices.

Project Planning & Execution

MYTILINEOS, through its business activities, is exposed to the potential failure to monitor all critical aspects for the effective/efficient completion and delivery of projects, including budget, resourcing aspects (e.g., staffing) as well as project objectives such as key milestones, logistics, quality and product safety.

More specifically, potential failure to properly manage projects impacts the time, cost, quality and safety of work and leads to failure to meet client expectations which could result in legal disputes over contractual terms and corresponding financial damages.

Moreover, potential delays or failure to deliver projects with significant exposure could lead to reputational damage and failed business relationships and thus to the loss of future business opportunities due to reliability concerns.

Additionally, potential failure to properly execute internal projects could adversely impact the strategic objectives in terms of growth and enhancement of operational efficiency.

Root Causes/Factors

i. Cost and schedule overruns during the execution of new projects or O&M activities.

ii. Inadequate understanding of complexities and key factors necessary for the successful completion of the project.

iii. Poorly defined contractual terms and conditions.

iv. Inadequate risk assessment and management of project risks.

v. Lack of project progress monitoring and reporting.

vi. Failure to effectively manage third parties’ non-adherence to contract commitments (project withdrawal).

Appetite

We have low appetite for Project Planning & Execution Risk. We seek to ensure efficient and effective planning and execution in order to deliver our projects according to predefined cost, schedule and quality.

Mitigation

Proper project execution and delivery is a main priority for MYTILINEOS, which is achieved through a robust project planning and monitoring procedure and long-term, strong business relationships with key stakeholders.

Planning, monitoring and reporting of project execution is achieved through well-established and regularly reviewed and updated project management processes.

MYTILINEOS clearly defines roles, responsibilities, milestones and corresponding tasks through the establishment of the projects’ governance prior to their initiation, ensuring optimal competency mix in project teams and timely planning. Furthermore, preliminary project review and project planning include risk identification and assessment phases.

MYTILINEOS performs thorough assessments of its suppliers, subcontractors and external partners before entering into any business agreement. Also, processes are established to ensure that their performance is being monitored throughout the execution of the projects.

Moreover, project teams perform lessons learned reviews at the end of each project to obtain an overview of the overall project execution and results aiming to draw conclusions that would enhance future project performance.

Liquidity Risk

Liquidity risk is related with the Group’s need for the sufficient financing of its operations and development. The relevant liquidity requirements are the subject of management through the meticulous monitoring of debts of long term financial liabilities and also of payments made on a daily basis.

Mitigation

The Group ensures that there is sufficient available credit facilities to be able to cover its short-term business needs, after the calculation of cash flows arising from the operation as well as cash and cash equivalents which are held. The funds for long-term liquidity needs ensured by a sufficient amount of loanable funds and the ability to sell long-term financial assets.

The tables below summarize the maturity profile of the Group’s liabilities as at 31.12.2022 and 31.12.2021 respectively:

| MYTILINEOS GROUP | |||||

|---|---|---|---|---|---|

| Liquidity Risk Analysis — Liabilities (Amounts in thousands €) 2022 | up to 6 months | 6 to 12 months | 1 to 5 years | after 5 years | Total |

| Long Term Loans | - | - | 1,545,868 | 1,203 | 1,547,070 |

| Short Term Loans | 139,896 | 669 | 5,380 | - | 145,945 |

| Leasing liabilities | - | - | - | - | - |

| Trade and other payables | 1,025,977 | 86,932 | 2,190 | - | 1,115,100 |

| Other payables | 786,204 | 201,512 | 2,557 | 10,356 | 1,000,629 |

| Derivatives | 33,327 | 30,605 | 6,019 | - | 69,951 |

| Current portion of non — current liabilities | 9,024 | 10,716 | - | - | 19,740 |

| Total | 1,994,429 | 330,434 | 1,562,014 | 11,558 | 3,898,435 |

| MYTILINEOS GROUP | |||||

|---|---|---|---|---|---|

| Liquidity Risk Analysis — Liabilities (Amounts in thousands €) 2021 | up to 6 months | 6 to 12 months | 1 to 5 years | after 5 years | Total |

| Long Term Loans | - | - | 1,265,129 | 15,274 | 1,280,403 |

| Short Term Loans | 38,828 | 659 | 749 | - | 40,236 |

| Trade and other payables | 690,188 | 199,668 | 2,210 | - | 892,066 |

| Other payables | 223,315 | 87,348 | 15,091 | 183,432 | 509,185 |

| Derivatives | 56,951 | 60,299 | 26,973 | - | 144,223 |

| Current portion of non — current liabilities | 26,798 | 7,891 | - | - | 34,689 |

| Total | 1,036,080 | 355,866 | 1,310,152 | 198,706 | 2,900,804 |

| MYTILINEOS S.A. | |||||

|---|---|---|---|---|---|

| Liquidity Risk Analysis — Liabilities (Amounts in thousands €) 2022 | up to 6 months | 6 to 12 months | 1 to 5 years | after 5 years | Total |

| Long Term Loans | - | - | 820,262 | - | 820,262 |

| Short Term Loans | 100,079 | - | - | - | 100,079 |

| Trade and other payables | 836,489 | 86,932 | 2,190 | - | 925,611 |

| Other payables | 1,089,868 | 59,203 | 1,837 | - | 1,150,908 |

| Derivatives | 32,920 | 26,176 | 6,019 | - | 65,115 |

| Total | 2,059,356 | 172,311 | 830,308 | - | 3,061,975 |

| MYTILINEOS S.A. | |||||

|---|---|---|---|---|---|

| Liquidity Risk Analysis — Liabilities (Amounts in thousands €) 2021 | up to 6 months | 6 to 12 months | 1 to 5 years | after 5 years | Total |

| Long Term Loans | - | - | 655,505 | - | 655,505 |

| Short Term Loans | - | - | - | - | - |

| Trade and other payables | 554,512 | 91,057 | 2,208 | - | 647,777 |

| Other payables | 447,787 | 26,891 | 1,837 | 168,859 | 645,374 |

| Derivatives | 56,951 | 60,299 | 26,973 | - | 144,223 |

| Total | 1,059,250 | 178,247 | 686,524 | 168,859 | 2,092,880 |

*see analysis 3.2

It must be noted that the above table does not include liabilities to clients from the performance of construction projects, as the maturity of such values cannot be assessed. Moreover, cash-advances from customers, construction contacts liabilities as well as the provisions and accrued expenses are not included.

Price Risk

Goods prices that are mainly determined by international markets and global offer and demand result in the Group’s exposure to the relevant prices fluctuation risk.

Goods’ prices are connected both to variables that determine revenues (e.g. metal prices at LME) and to the cost (e.g. natural gas prices) of the Group’s companies. Due to its activity, the Group is exposed to price fluctuation of aluminium (AL) as well as to price fluctuation of natural gas, as production cost.

Mitigation

As regards price fluctuation, the Group’s policy is to minimize risk by using financial derivative instruments.

Interest rate risk

The Group’s assets that are exposed to interest rate fluctuation primarily concern cash and cash equivalents.

Mitigation

The Group’s policy as regards financial assets is to invest its cash in floated interest rates so as to maintain the necessary liquidity while achieving satisfactory return for its shareholders.

In addition, for the totality of its bank borrowing, the Group uses floating interest rate instruments. Depending on the level of liabilities in floating interest rate, the Group proceeds to the assessment of interest rate risk and when necessary examines the necessity to use interest bearing financial derivative instruments. The Group’s policy consists in minimizing its exposure to interest bearing cash flow risk as regards long term funding.

Effect from risk factors and sensitivities analysis

The effect from the above mentioned factors to Group’s operating results, equity and net results as at 31.12.2022 and 31.12.2021 presented in the following table:

2022

| LME AL (Aluminium) | $/t | + 50 | − 50 |

|---|---|---|---|

| EBITDA | m. € | 8,9 | (8,9) |

| Net Profit | m. € | 8,9 | (8,9) |

| Equity | m. € | 8,9 | (8,9) |

| API (Alumina) | $/t | + 10 | − 10 |

|---|---|---|---|

| EBITDA | m. € | 0,3 | (0,3) |

| Net Profit | m. € | 0,3 | (0,3) |

| Equity | m. € | 0,3 | (0,3) |

| Exchange Rate €/$ | €/$ | -5% | +5% |

|---|---|---|---|

| EBITDA | m. € | 43,1 | (40,4) |

| Net Profit | m. € | 37,7 | (35,0) |

| Equity | m. € | 37,7 | (35,0) |

| NG Price | €/MWh | -5% | +5% |

|---|---|---|---|

| EBITDA | m. € | 16,0 | (16,0) |

| Net Profit | m. € | 16,0 | (16,0) |

| Equity | m. € | 16,0 | (16,0) |

| CO2 (€/t) | €/t | - 1 | + 1 |

|---|---|---|---|

| EBITDA | m. € | 1,7 | (1,7) |

| Net Profit | m. € | 1,7 | (1,7) |

| Equity | m. € | 1,7 | (1,7) |

2021

| LME AL (Aluminium) | $/t | + 50 | − 50 |

|---|---|---|---|

| EBITDA | m. € | 7.8 | (7.8) |

| Net Profit | m. € | 7.8 | (7.8) |

| Equity | m. € | 7.8 | (7.8) |

| API (Alumina) | $/t | + 10 | − 10 |

|---|---|---|---|

| EBITDA | m. € | 2,7 | (2,7) |

| Net Profit | m. € | 2,7 | (2,7) |

| Equity | m. € | 2,7 | (2,7) |

| Exchange Rate €/$ | €/$ | -5% | +5% |

|---|---|---|---|

| EBITDA | m. € | 32,3 | (30,3) |

| Net Profit | m. € | 30,8 | (28,8) |

| Equity | m. € | 30,8 | (28,8) |

| NG Price | €/MWh | -5% | +5% |

|---|---|---|---|

| EBITDA | m. € | 34,7 | (34,7) |

| Net Profit | m. € | 34,7 | (34,7) |

| Equity | m. € | 34,7 | (34,7) |

| CO2 (€/t) | €/t | - 1 | + 1 |

|---|---|---|---|

| EBITDA | m. € | 2,1 | (2,1) |

| Net Profit | m. € | 2,1 | (2,1) |

| Equity | m. € | 2,1 | (2,1) |