Report on the activities of the Audit Committee

Introduction

The Audit Committee (hereafter the «Committee») is pleased, through the present report, to inform the Annual General Meeting of Shareholders on how the Committee has discharged its responsibilities during very demanding and challenging times for one more year.

This year’s report provides information on the Committees activities in 2022, as well as the main points on which its discussions and work focused. In addition to the main areas of discussion, within the scope of its responsibilities presented below, the Committee addressed important issues of the Company as these emerged from the Management’s periodic updates to the Committee during the year.

The Committee believes that continuous enhancement of our internal control environment continues to be key to the Company’s sustainability.

In 2023, the Committee will focus on the most important issues and potential risks within its responsibilities, while it will continue to monitor the potential effects of the COVID-19 pandemic on the Company.

The purpose of the Committee and its key responsibilities

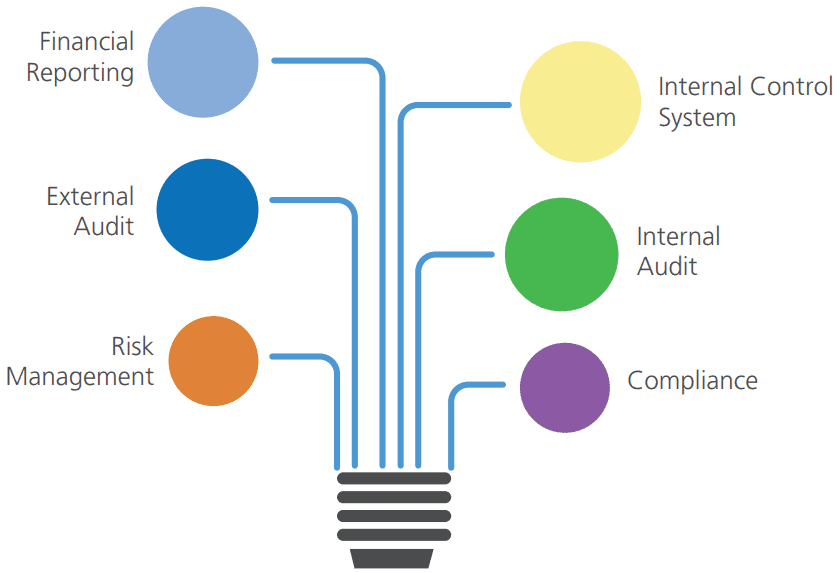

The Committee has been established to assist the Board of Directors (the «Board») in fulfilling its oversight responsibilities regarding audit procedures that ensure compliance with the legal and regulatory framework regarding:

a) financial information;

b) the System of Internal Controls, including the Internal Audit Division, the Risk Management Function and the Regulatory Compliance Function; and

c) supervision of the (external) statutory audit of the Company’s individual and consolidated financial statements.

While all members of the Board individually and collectively have a duty to act in the interests of the Company, the Committee has a particular role, acting independently from the executive Board Members, to ensure that the interests of shareholders are properly protected in relation to financial reporting and internal control and risk management systems. However, the Board has overall responsibility for the Company’s approach to risk management and the system of internal controls.

The Committee reports to the Board on how it discharges its responsibilities and makes recommendations to the Board. A full list of responsibilities is provided in the Committee’s terms of reference, which was found in no need for any amendment during 2022. The Committee’s Terms of Reference, which is approved by the Board of Directors, is available at website.

The Committee shall report to the Board, quarterly or whenever deemed appropriate, on the Committee’s work, including indicatively:

i. the significant, critical and substantive issues concerning the preparation of the financial reports and how these issues were addressed;

ii. its assessment of the effectiveness of the statutory audit process and its recommendation on the appointment, reappointment or removal of the Statutory Auditor;

iii. any issues on which the Board has requested the Committee’s opinion;

iv. the outcome of the statutory audit and an explanation of how the statutory audit contributed to the integrity of financial reporting, and what the role of the Committee was in that process; and

v. the reports that the Internal Audit Director submits to the Committee, with regards to the activities of the Internal Audit Division.

In summary the main responsibilities of the Committee include oversight responsibilities on the audit procedures that ensure compliance with the legal and regulatory framework regarding:

The members of the Committee have stated that they accept their responsibilities and duties and that they will perform their activities in accordance with the applicable Terms of Reference of the Committee, the Internal Regulation Code of the Company, and the law.

Composition of the Committee, skills and experience

The Committee is a committee of the Board of Directors and consists of at least three (3) members, who in their entirety are independent non-executive members of the Board. The Committee members shall be appointed by the Board following the recommendation of the Company’s Remuneration and Nomination Committee. The Committee Chair shall be appointed by the Committee members. The Chair of the Board cannot be a member of the Committee.

According to the Terms of Reference of the Committee, the tenure of office of its members is similar to the term of office of the Board, which is four years, unless otherwise decided by the General Meeting of the Shareholders or by delegation by it to the Board. The tenure of office of this Committee shall expire on 02.06.2026 (automatically extended until the first ordinary general meeting, after the end of the tenure of the Board).

Composition / Tenure of the Committee

The following table depicts the composition of the Committee during 2021, the tenure of its members as well as relevant notes / clarifications:

| Member | Title | Duration |

|---|---|---|

| Alexios Pilavios | Chair | 02.06.2022 — 02.06.2026 |

| Konstantina Mavraki | Member | 02.06.2022 — 02.06.2026 |

| Anthony Bartzokas | Member | 02.06.2022 — 02.06.2026 |

It is worth mentioning that:

(*) The Ordinary General Meeting of the Company’s shareholders dated 15.06.2021, in accordance with the provisions of article 44 of law 4449/2017, as amended and in force, decided that the Audit Committee will be a committee of the Board of Directors, which shall consist of three independent non-executive members of the Board. In this context, the Board of the Company on 02.06.2022 appointed three of its independent members as members of the Audit Committee.

Attorney Mrs Vassiliki Prantzou is the Committee’s Secretary. The Corporate Secretary cooperates with the Secretary of the Committee and assists the Committee within the framework of her responsibilities.

The members of the Committee have competencies related to the sectors in which the Company operates, as they have sufficient knowledge in the field of industrial products and services, in auditing or accounting and experience in the areas of Corporate Governance and Internal Control Systems.

Detailed curriculum vitae of the members of the Committee are attached to this Report.

Finally, the Committee has at its disposal the necessary resources to enable it to obtain the assistance of external consultants, if required. In 2022, the Committee was provided with advisory services by Mr. Cotsilinis, an independent advisor, on accounting and auditing issues, as well as by Deloitte on organizational matters of the Committee in compliance with the legislative and regulatory framework.

Committee Meetings and Operation

The Committee meets at regular intervals, at least four (4) times per year, and holds extraordinary meetings when required. The Committee Chair discusses with the Board on the work of the Committee at at every scheduled Board meeting, according to the annual meeting schedule/calendar.

For 2022, the Committee met frequently (14 times in total) and discussed all the topics falling under the areas of its responsibilities, with its main focus on: a) External Audit and Financial Reporting process, b) Internal Audit, c) Internal Control System, d) Organisational matters, e) Other topics relevant to the mandate of the Committee. All the Committee’s decisions were unanimous.

All members of the Committee attended all the meetings for 2022. The meetings of the Committee that concern the approval of the financial statements were attended by all the members of the Committee that have sufficient knowledge and experience in auditing or accounting.

In addition to the members of the Committee, the Secretary and the Corporate Secretary participate in the meetings when they are not the same person. It is at the discretion of the Committee to invite, whenever deemed appropriate, other members of the Board, or other key persons from inside and outside the Company, to inform it and / or attend a specific meeting or specific items of the agenda. The Chief Financial Officer (CFO), the Treasury General Manager, the Internal Audit Director, the Compliance Director, the Non-financial enterprise risk Manager as well as the statutory auditor or audit firm are invited regularly to the Committee meetings, at the Committee Chair’s initiative.

Financial Reporting

Publication of non-audited financial figures and other key information — «Flash Notes»

The Finance Division presented to the Committee the preliminary financial results which were published subsequently by the Company in the form of a «Flash Note», for the financial year ended 31 December 2021, as well as for the period from 01 January 2022 to 30 June 2022 respectively. The aforementioned «Flash Notes» referred to non-audited financial figures and estimates of the Management and forecasts relating to financial data or other events of the above periods. It is noted, however, that the external auditor carried out specific pre-agreed procedures on the «Flash Notes», for the purpose of issuing «Comfort Letter» to the Company’s Management. In the «Comfort Letter» of the external auditors, no disagreements were expressed with regards to the data reported through the «Flash Notes». The Committee did not identify any gaps or deviations in the information and safeguards provided to it and recommended to the Board the approval of the publication of the «Flash Notes». Finally, the Committee reviewed the relevant press releases on the "Flash Notes"’.

Financial Statements 2022

In March 2023, the Committee was informed by the Finance Division about the Company’s Financial Statements, both at company and at consolidated level, which were prepared in accordance with the IFRS for the year ended 31 December 2022. The Committee was also informed regarding the main accounting assumptions the Company adopted for preparing the Financial Statements which did not differ from those adopted by the Company in 2020, and regarding the key issues the Finance Division considered while preparing these Statements.

The Committee discussed with the external auditor (Grant Thornton) and the Finance Division the key audit matters during the audit of the Company’s annual financial statements for the financial year ended 31 December 2022. The Committee drafted an explanatory report for the Board of Directors and recommended that the Board approves the Financial Statements. In this report, the Committee explained to the Board how the mandatory audit contributed to the integrity of financial reporting and what the role of the Committee was in this process. In this context, the Committee evaluated and concluded that the annual financial report, along with the annual financial statements and the annual management report of the Company, reflect in a true, fair, balanced and understandable manner the evolution, performance and position of the Company, as well as of the companies included in the consolidation, and provide the required information to the shareholders. The Committee also informed the Board that the external auditors have contributed substantially to the integrity of the Financial Statements with their experience and independent assurance that the financial statements reasonably present, in all material aspects, the financial position of the Company and the Group as at 31st December 2022, their financial performance and their cash flow for the year ended on that date.

Financial Results 3rd quarter 2022

The Finance Division informed the Committee on the financial results of 3rd quarter 2022 and brought to its attention the relevant draft announcement to the investors. The Committee, after receiving assurance on the correctness and accuracy of the information that will be made public, expressed its satisfaction for the Company’s progress.

Semi-Annual Financial Results 2022

The Finance Division informed the Committee on the semi-annual financial results of 2022 and no gaps or deviations were identified in the assurance provided on the correctness and accuracy of the information. The Committee drafted an explanatory report on the review of the Company’s half-yearly individual and consolidated financial statements to the Board.

Financial Results 1st quarter 2022

The Finance Division informed the Committee on the financial results of 1st quarter 2022 and brought to its attention the draft relevant announcement to the investors. The Committee, after receiving assurance on the correctness and accuracy of the information that will be made public, expressed its satisfaction for the Company’s progress.

External (Statutory) Auditors

Appointment of the external auditors

The Committee has primary responsibility for the appointment of the key audit partner (external auditor). This includes negotiating the fee and scope of the audit, initiating a tender process, expressing an opinion regarding the appointment of an engagement partner and making formal recommendations to the Board on the appointment, reappointment and removal of the external auditors.

In April 2022, the Committee, after assessing the work of Grant Thornton, which is the Company’s external auditor, and taking into account, inter alia, the opinion of the Finance Division, decided to propose to the Board of Directors the reappointment of the audit firm Grant Thornton as external auditor for the fiscal year 2022.

In 2023, the Committee is scheduling the conduct of a tender for the selection of a new external auditor, in the context of the implementation of Regulation (EU) No 537/2014 of the European Parliament and of the Council of 16 April 2014 and the relevant transitional provisions of article 52 of Law 4449/2017 regarding the specific requirements for the statutory audit of public-interest entities, since Grant Thornton has been appointed as external auditor for the past 20 years.

Safeguarding independence and objectivity, and maintaining effectiveness

In its relationship with the external auditors, the Committee needs to ensure that they retain their independence and objectivity and are effective in performing the statutory audit. Both the Board and the external auditor have policies and procedures designed to protect the independence and objectivity of the external auditor.

The Committee considers the external auditors’ annual declaration of independence and discusses with them threats, that may threaten their independence, as well as ways to ensure that these threats are addressed. The Committee examined whether the relationships, considering the views of the external auditor, of the Management and of the internal audit, as appropriate, appear to affect the auditor’s independence and objectivity.

In 2022, the external auditors submitted to the Committee the declaration of their independence from the Company in accordance with the Code of Ethics for Professional Accountants of the International Ethics Standards Board for Accountants (IESBA Code) and the ethical requirements related to the audit of the financial statements in Greece.

Financial Statements

The Committee has devoted a significant amount of time during its meetings in order to be informed and to discuss the process for the preparation of the annual and semi-annual Financial Statements. Main matters and activities performed were as follows:

| Matter | Activity |

|---|---|

| Statutory Audit Planning | The External Auditors presented to the Committee a report, which, inter alia, reflected the plan of communication between the external auditors and the Committee in relation to the timing of the statutory audit, of the separate and consolidated statements of the Company and its subsidiaries for the financial year 31.12.2022, the audit teams and specialists, as well as a reference to the key audit matters during the audit planning and in particular to the identified risks of the financial statements. |

| Audit of Annual Financial Statements — Key Audit Matters, and for the quarters ended 31 December 2022, 31 March 2022, 30 June 2022, and September 30, 2022. | The Committee monitored the audit of the Company’s annual financial statements for the financial year ended 31.12.2022 by the external auditors. The external auditors commented, inter alia, on the determination of materiality and discussed with the Committee on the methodology and parameters for its determination. More specifically, the external auditors informed the Committee that for the calculation of materiality, the Earnings Before Tax has been defined as an appropriate benchmark, given that the Company is listed on the Athens Stock Exchange In the discussions with the external auditors, particular emphasis was placed on the «Key Audit Matters» as identified by the external auditors, and how they these were treated during the audit.

The Committee examined and discussed in detail the above issues with the external auditors, without the presence of executives of the Company’s Finance Division. |

| Report of the Audit Committee to the Board of Directors on the Financial Statements 2021 | The Committee, following the review of the Financial Statements of the parent company and the Group for the year ended 31st December 2021 and the discussions held with the Finance Division and the external auditors, proposed their approval to the Board. |

| Tax Audit | The external auditors, in a meeting with the Committee without the presence of executives of the Company’s Finance Division, informed the members of the Committee about:

|

| Review of Interim Financial Statements | The external auditors informed, through a relevant report/ presentation, the Committee on their review of the Interim Financial Statements for the first half of 2022 carried out in accordance with ISA . The auditors referred, inter alia, to the scope and areas, as well as their procedures for the review of the Group, the determination of materiality, unrecorded misstatements and the key issues of their review. |

| Additional Report to the Audit Committee for 2022 | The External Auditors submitted and presented to the Committee their additional report, as provided by article 11 of EU Regulation 537/2014 on their audit of the Company and Group Financial Statements for the year ended 31 December 2022. |

| Additional Report to the Audit Committee for 2021 | The External Auditors submitted and presented to the Committee their additional report, as provided by article 11 of EU Regulation 537/2014 on their audit of the Company and Group Financial Statements for the year ended 31 December 2021. |

Use of the external auditors for non-audit services

The Committee monitors the external auditors’ compliance with the provisions of Regulation (EU) No 537/ 2014, as in force, regarding the level of the total fees paid by the Company to them in proportion to the overall fee income of the external auditors or their overall fee income from audit services, as well as other related regulatory requirements, so that the external auditors’ independence and objectivity is not impaired by the amount of work provided to the Company.

The Committee is responsible for approving non-audit services to the Group entities that are not prohibited by law. The Committee considers that the external auditors have significant knowledge of the Group’s business and of how accounting policies are applied. That means it is sometimes cost-efficient for them to provide non-audit services. There may also be confidentiality reasons that make the external auditors the preferred choice for a particular non audit assignment.

However, safeguarding the external auditors’ objectivity and independence is an overriding priority. For this reason, the Committee ensures that the provision of such services does not impair the external auditors’ independence or objectivity.

In the context of non-audit services, whose provision by the Statutory Auditor is not prohibited by law, the Committee should apply judgement on and assess the following:

i. threats to independence and objectivity resulting from the provision of such services and any safeguards in place to eliminate or reduce these threats to a level where they would not compromise the auditors’ independence and objectivity;

ii. the nature of the non-audit services;

iii. whether the skills and experience of the audit firm make it the most suitable supplier of the non-audit services;

iv. the fees incurred, or to be incurred, for non-audit services both for individual services and in aggregate, relative to the audit fee, including special terms and conditions (for example contingent fee arrangements), and

v. the criteria which govern the compensation of the individuals performing the audit.

During 2022, the Committee examined the non-audit services that were proposed to be performed by the external auditor for the Company or subsidiaries of the Group, where the Committee, after evaluating the nature of proposed services and receiving relevant clarifications, declarations and assurance from the external auditor, considered that they did not pose a threat to the external auditor’s independence in accordance with the provisions of article 44 of Law 4449/2017 and article 5 of Regulation (EU) 537/2014. The relevant non-audit services concerned pre-agreed procedures (a) in relation to the preparation of the financial statements (including the Explanatory Notes), which would concern fund agreements, calculations, drafts, data collection, analysis and related processing thereof, with the note that these analysis would be based on an approved trial balance by each Management function, as well as that the adjustment entries would be subject to the approval of the each Management function of the subsidiaries, (b) in the context of supporting the respective Management function for the technical implementation of the conversion processes to IFRS, c) on the calculation of financial indicators of the Company and its subsidiaries in the context of their compliance with the requirements of loan agreements with the creditors (banks), (d) regarding the proper compilation of the company’s financial statements per activity / sector, in accordance with the provisions of Law 4001/2001, (e) for the audit of the 2021 Remuneration Report of the Company, (f) on each Flash Report and Trading Update of the Company, (g) for the issuance of assurance reports in the context of the examination of the implementation of the financial scope of the Company’s investment plans and its subsidiaries that have been subject to the provisions of Law 4399/2016, and (h) on the financial data for the table «CONSTRUCTION EXPERIENCE AND COMPETENCE DATA» in the context of the Company’s participation in public tenders. The external auditors, during 2022, apart from the regular audit and the tax certificate report, provided non-audit consulting services for a total amount of €153,000, corresponding to 20.23% of the average total audit fee it received for over the last three years

Neither the work done, nor the fees payable of the assigned non audit services, compromised the independence or objectivity of our external auditors.

Internal Audit

Following relevant recommendation by the Committee, the BoD appointed Mrs. Mariza Melliou as new Internal Audit Director as of 14.03.2022. In monitoring the activity, role and effectiveness of the Internal Audit Division (IAD) and its audit program, the Committee had frequent meetings with the Internal Audit Director. The main matters examined through 2022 related to the following:

| Matter | Activity |

|---|---|

| Internal Audit Plant 2022 | The Internal Audit Division submitted to the Committee for approval the internal audit plan for 2022, which is subject to revisions, depending on the extraordinary needs of the Company, including the suggested relevant budget. In addition, the Internal Audit Division submitted and presented to the Committee the strategic priorities of the Division for the years 2022-2025. |

| Quarterly Reports 2022 | The Internal Audit Division submitted and presented to the Committee quarterly reports on its activities for the year 2022, including scheduled activities and the progress of the internal audit plan. The Committee was also informed by the Internal Audit Division regarding the audits performed and the reports issued during 2022. The Committee considered the major findings of the internal audits, as well as Management’s response and informed the BoD accordingly. |

| Quarterly Follow-Up Reports 2022 | The Internal Audit Division submitted and presented to the Committee quarterly followup reports for 2022 on the Division’s suggestions on improvement of the Internal Control System. |

| Internal Audit Plan 2023 | The Internal Audit Division submitted to the Committee for approval draft of the summary internal audit plan for 2023, including estimated budget and availability of manpower. The internal audit plan is subject to revisions according to the dynamic method of developing the annual plan. |

| Internal Audit Coverage | The Committee monitored the progress of internal audit assignments performed by the Internal Audit Division, which related to the coverage of key risk areas, based on the risk based Internal Audit Plan 2022 and informed the BoD accordingly. Pursuant to the Internal Audit Plan, that was completed at satisfactory level, there is no conclusion that the Corporate Governance and Internal Control System face material weaknesses for 2022. |

| Internal Audit Division’s Terms of Reference | The Committee approved the amendment of the Internal Audit Division’s Terms of Reference. |

| External Evaluation and Certification of the Internal Audit Division | The Committee assigned and monitored the evaluation and IAA certification (RPAI 2020) of the Internal Audit Division by external institution. |

| Annual Evaluation of the Internal Audit Director | The Committee approved the KPIs of the Internal Audit Division’s Director. The annual evaluation of the Internal Audit Division’s Director is scheduled during the 1st quarter 2023. |

Internal Control System

Specific related matters that the Committee considered for the year 2022 included the following activities:

| Matter | Activity |

|---|---|

| Evaluation of Internal Control System | Following evaluation of relevant offers and recommendations by the Chief of Staff, the Committee suggested to the BoD the assignment of the relevant evaluation of the Internal Control System of the Company, including the central divisions and functions, the business units and the subsidiary «KORINTHOS POWER» for the period between 17.72021 until 31.12.2022 to Grant Thornton. |

| Enterprise Risk Management Policy and Risk Appetite | The Committee suggested to the BoD the Enterprise Risk Management Policy proposed by the Chief of Staff, as well as the Risk Appetite. |

| Financial Risks | The General Manager Treasury presented to the Committee an analysis of the management of financial risks of the Company at Group level. |

| Information Systems Security | In the course of the annual internal audit plan, the Internal Audit Division evaluated the security of the IT systems in subsidiaries of the Company. |

| ESG Risks | The Committee was informed by the Corporate Governance and Sustainability General Division regarding the main ESG risk categories and the role of the Sustainability Division in ESG risk management and mitigation. |

| Project for the assessment of the adequacy of the procedures of central and support function within the COSO 2013 framework | The Committee was informed about the progress of the project «Assessment of the adequacy of the processes of central and support functions within the framework of COSO 2013 Internal Control System» by the Chief of Staff, as well as by the external consultant to whom the relevant project has been assigned. |

| Strategy and M&A | The Committee discussed with the General Manager Strategy and M&A, the role, goals and involvement of the General Division in the decision taking process on various transactions. |

| Evaluation of the internal control procedures over financial reporting of the Company and the Group by the External Auditors | The external auditors presented to the Committee their report for the evaluation of the internal control procedures over financial reporting of the Company and the Group based on their audit for the year 2021 (Management letter). |

| Regulatory Compliance | The Committee was informed by the Compliance Division on the annual report of its activities for 2022 and approved the Division’s annual work plan for 2023. The Compliance Division informed the Committee on semi-annual basis of the operation of the whistleblower line for violations of the Company’s Code of Conduct. |

Other Significant Matters

| Matter | Activity |

|---|---|

| Annual work plan for 2023 | The Committee approved its annual work plan for the year 2023. |

| Reports to the Board of Directors | The Committee prepared and submitted reports on its activities to the BoD for the year ended 31 December 2021, and for the quarter |

| Annual Report on the activities of the Audit Committee for the year ended 2021 | The Committee submitted its Annual Report on its activities for the year ended 2021 to the General Assembly of the Shareholders of 2nd June 2022. |

| Evaluation of the Audit Committee | The evaluation of the BoD, including its Committees, by external consultant was completed in 2022. The evaluation of the Committee by external consultant for the year 2022 is in progress. |

Sustainable Development Strategy

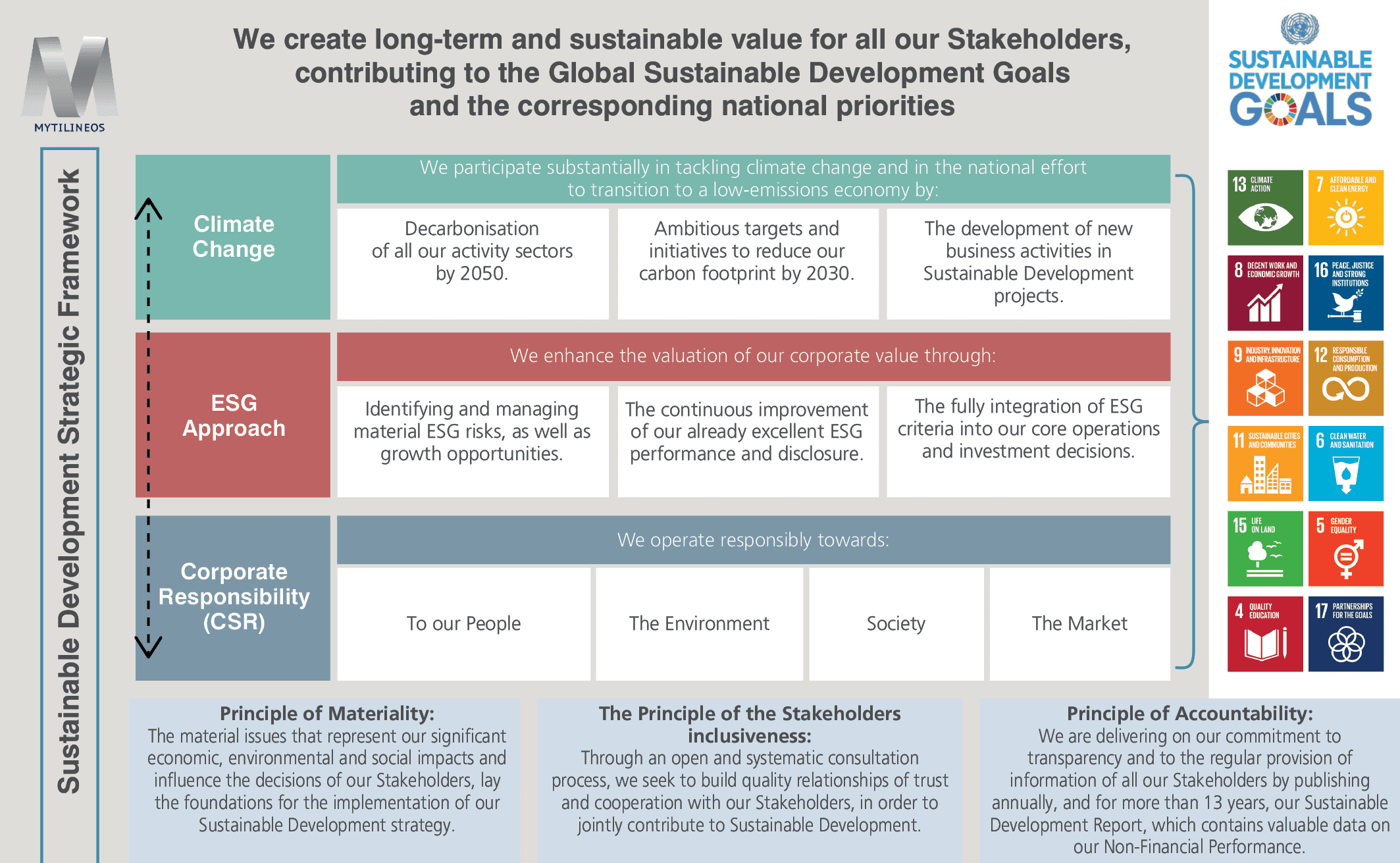

Sustainable Development is an integral part of the MYTILINEOS long-term business strategy. It is the driving force through which the Company aspires to remain competitive in the long term, to meet contemporary challenges and, by developing appropriate partnerships, to contribute to a new and efficient model of socially inclusive growth, as this is reflected in the Sustainable Development Goals.

The Company’s Sustainable Development Strategy is aimed at creating long-term and sustainable value for shareholders and other Stakeholder groups, through a holistic approach that combines economic stability with social and environmental sustainability. It is implemented on three basic levels that are inseparable from one another and is governed by specific Principles that ensure completeness (Materiality Principle), quality (Stakeholder Inclusiveness Principle) and transparency (Accountability Principle) across all its activities.

More specifically:

The first level expresses the Company’s commitment to tackling climate change and its contribution to a low-emissions economy. MYTILINEOS is fully aware that climate change is one of the most urgent issues facing the planet. Moreover, the Company, considering the high CO2 emission intensity in its production processes, has highlighted the adaptation of its activities to the consequences of climate change and the implementation of initiatives to address it, as key elements for its sustainable operation. In this respect, it has designed a local strategy to address climate change, which serves to guide its initiatives to reduce carbon dioxide emissions as defined by the Kyoto Protocol, the Paris Agreement on Climate Change (COP21) and the corresponding National Plan of Greece, which sets out its contribution to the European Green Deal (EU Green Deal).

i. To further adapt its activity to the consequences of climate change by analyzing the risks involved, while also taking advantage of the opportunities arising.

ii. To implement, control and review the initiatives and the corresponding CO2 emission reduction and net zero targets for 2030 and 2050.

iii. To integrate climate targets into the Company’s strategic planning and decision-making processes.

iv. To implement an investment plan in >2.5 GW of RES assets by 2030.

v. To develop strategic partnerships for the application of new technologies to production activities, with the aim of reducing the CO2 emission intensity.

vi. To further develop the activities of the new Renewables & Storage Development Business Unit.

The second level focuses on MYTILINEOS’ systematic approach to the recording, optimal management and disclosure of information about the ESG risks and opportunities that may affect its performance, as well as its efforts to implement its strategy. Through the ESG approach, MYTILINEOS strengthens its ability to create long-term value and manage significant changes in the environment in which it operates. In this way, it responds to the modern-day sustainability requirements of investors, capital markets and financial institutions, as well as to society’s expectations of commitment and transparency regarding these issues, whose number keeps increasing.

i. To determine Material ESG topics and link them to the Company’s financial performance.

ii. To optimally manage of ESG risks and opportunities to create long-term value.

iii. To enhance the trust and facilitate the flow of information between the Company and the investor community.

iv. To responsibly disclose Non-Financial Information in accordance with the international standards.

v. To constantly improve / maintain ESG performance levels.

vi. To integrate ESG criteria into the Company’s investment decisions and into main operating procedures.

The third level focuses on the responsible operation of MYTILINEOS, which has been systematically cultivated, since 2008, through the implementation of Responsible Entrepreneurship and the Company’s commitment to the 10 Principles of the UN Global Compact. For MYTILINEOS, Responsible Entrepreneurship is an ongoing self-improvement and incessant learning process, while it also serves as a key mechanism for renewing its «social license to operate», while at the same time it helps improve its competitiveness at national and international level.

i. To remain committed to its objective of ensuring a healthy and safe work environment without accidents, adopting a prevention-oriented approach.

ii. To constantly mitigate the environmental impacts of its activity.

iii. To develop, manage and retain a dedicated human capital, with practices that promote an inclusive working environment, with equal opportunities and respect for Human Rights.

iv. To continue to treat its people with responsibility and consistency, remaining their first choice of employer during their entire career paths, while at the same time investing in their training and in the development of their skills.

v. To implement actions of high social value, including through the development of employee volunteering.

vi. To engage in a systematic and honest dialogue with its key Stakeholder groups, seeking to maintain mutual trust and as well as a fuller understanding by the Company of the impacts of its operation.

vii. To contribute to the development of local infrastructure and, overall, to the prosperity and the respect of the rights of the citizens of the local communities adjacent to the Company’s industrial units.

viii. To develop responsible procurement / purchases by expanding the commitment of the Company’s key suppliers and business partners to sustainable development.

ix. To place emphasis on the quality and safety standards of the Company’s products as well as on the continuous support, service and satisfaction of customers.

Marousi, 08.03.2022

The Audit Committee

Alexios Pilavios

Konstantina Mavraki

Anthony Bartzokas